- Stablecoins tied to the dollar are not classified as securities and therefore avoid heavy financial regulations.

- This makes them more convenient for everyday purposes such as spending money or transferring cash.

- Simple stablecoins and only fully backed ones, such as USDC and USDT, are accepted at present.

Stablecoins are cryptocurrencies that are meant to maintain a stable value, unlike the frequent price swings of Bitcoin or Ethereum.

On April 4, 2025, the U.S. Securities and Exchange Commission (SEC) made an announcement that stablecoins linked 1:1 to the U.S. dollar are not seen as securities. So, they don’t have to follow heavy regulations like stocks or bonds. This makes stablecoins more practical for everyday use, such as buying goods or sending funds.

What Makes a Stablecoin “Covered”?

“covered stablecoins” They’re the ones that always match the value of one U.S. dollar. For every coin in circulation, there’s a real dollar or something very safe like U.S. Treasury bills kept in reserve. You can swap them for dollars anytime.

The SEC says these coins are built for daily use, such as paying bills or saving money, not for chasing profits like stocks or investments. That’s why they don’t fall under securities rules, which deal with investments meant to grow in value.

The SEC used two legal tests to confirm this, the Reves and Howey tests. Reves checks if something works like a regular financial tool, not a risky asset. Howey checks if people expect to make money from others’ work. Covered stablecoins passed both tests, that they’re meant for spending, not betting, and their value stays steady.

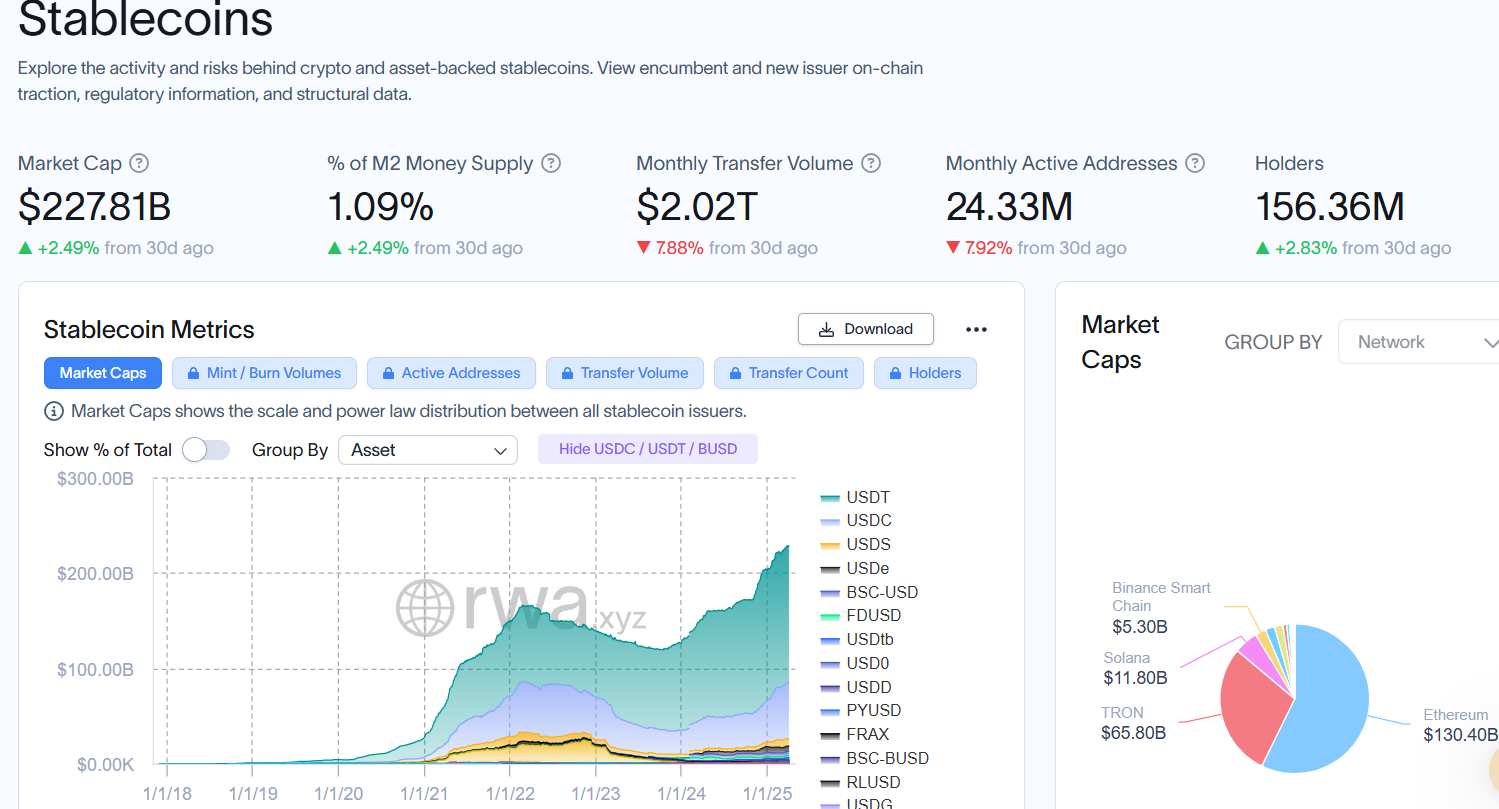

Current stablecoin market overview. Source: RWA.XYZ

Regulatory Breakthrough for USDC, Tether, and Dollar-Linked Stablecoins

Companies aren’t allowed to promote these coins as ways to get rich fast. There should be no promises of interest or extra returns, just a safe way to pay or save. This ties into the STABLE Act of 2025, a law focused on keeping dollar linked coins truly stable. The response on X was loud and clear, that many called it a “game changer” for coins like Tether (USDT) and USD Coin (USDC), which can now grow without SEC hurdles.

The SEC now requires that these stablecoins be backed by solid reserves like cash or safe government bonds. The coin issuers can’t use the reserve for personal gain or risky investments. It’s all about making sure the value stays fixed.

This also supports major U.S. goals, like the GENIUS Act and the STABLE Act, aimed at strengthening the dollar worldwide. Tether, in fact, holds more U.S. Treasuries than many countries. In March 2025, Treasury Secretary Scott Bessent said stablecoins are vital to keeping the U.S. dollar strong around the globe.

The Guiding and Establishing National Innovation for US Stablecoins (GENIUS) of 2025 Act.

Source: US Senate

But not all stablecoins get this benefit. Those that use algorithms to stay stable or promise returns still fall under SEC rules. Right now, only the fully backed and basic stablecoins are being approved. Some hope for future changes that allow small returns for users, but that’s a debate for later. With a new SEC chair in place as of April 5, 2025, things are looking more crypto friendly, though Congress is still shaping broader laws.

In the end, the SEC’s move helps stablecoins act more like digital dollars without getting stuck in red tape. It’s a clear win for the crypto market, this gives coins like USDC and USDT more chances to grow and be used daily. Whether you’re shopping, trading, or learning about crypto, 2025 might be the year stablecoins become regular money.

Also Read: Mantra Token OM Drops 90% Due to Allegations and Liquidations