The Flyfish Club, a New York City-based NFT-driven dining club, has agreed to a $750,000 settlement with the U.S. Securities and Exchange Commission (SEC) following allegations of unregistered NFT sales and it’s the hot NFT news in the town. The SEC’s action comes after Flyfish Club sold approximately 1,600 NFTs from August 2021 to May 2022, raising about $14.8 million. These NFTs were marketed as memberships offering access to exclusive dining experiences at the club.

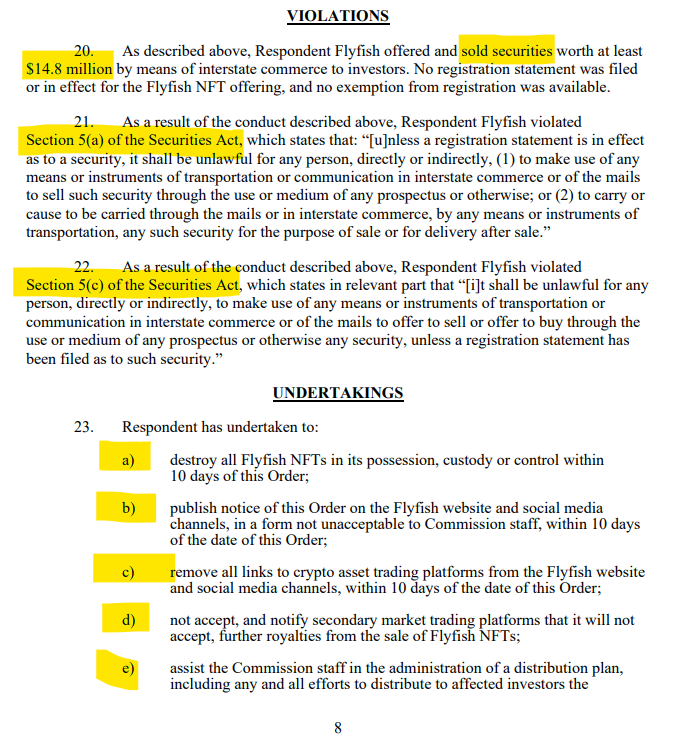

The SEC classified these NFTs as crypto-asset securities due to their potential for resale profits and passive income through leasing, arguing that Flyfish Club’s failure to register the offering constituted a violation of federal securities laws. As part of the settlement, Flyfish is required to halt acceptance of royalty payments from secondary sales.

Source : Check here

Civil Penalty :

Flyfish Club has been fined $750,000 by the U.S. Securities and Exchange Commission (SEC) for allegedly conducting an unregistered offering of NFTs. The SEC classifies these NFTs as crypto asset securities, meaning they fall under federal securities laws due to their investment characteristics.

Sales Timeline and Financial Impact :

Between August 2021 and May 2022, Flyfish Club sold approximately 1,600 NFTs, raising a total of around $14.8 million. These NFTs were promoted as “Omakase” memberships, providing access to a high-end, members-only restaurant in New York City. The NFTs were sold at two price points:

- 2.5 ETH (approximately $8,400)

- 4.25 ETH (approximately $14,300)

The SEC classified the Flyfish Club NFTs as investment contracts based on the Howey test, a legal standard used to determine whether an asset qualifies as a security. This test examines whether there is an investment of money, an expectation of profits, a common enterprise, and whether profits are derived primarily from the efforts of others. In the case of Flyfish Club, the SEC argued that the NFTs met these criteria by being marketed with the potential for resale profits and passive income through leasing.

According to the SEC, these factors combined indicated that the NFTs were not simply utility tokens but securities. The expectation of profit and the marketing of the NFTs as investment opportunities, along with the centralized efforts of Flyfish Club to create and maintain value, led the SEC to conclude that the NFTs should be regulated under federal securities laws.

Compliance Requirements :

As part of the settlement agreement, Flyfish Club must adhere to the following compliance requirements:

- Destruction of NFTs: The company must destroy all NFTs it currently holds within 10 days of the settlement order. This is aimed at removing any remaining assets that are considered to be in violation of securities laws.

- Public Notice: Flyfish Club is required to publish a notice about the settlement on its website and social media channels. This notice must inform the public and their investors about the settlement terms and the cessation of NFT activities.

- Removal of Links: The company must remove all links to crypto asset trading platforms from its website and social media channels. This step is intended to prevent further trading or speculation involving Flyfish NFTs.

- Notification to Secondary Markets: Flyfish Club must notify secondary market trading platforms to stop accepting royalties from the resale of Flyfish NFTs. This measure is to ensure that no further financial transactions occur involving these NFTs.

- Assistance with Distribution Plan: The company is required to assist the SEC staff with the administration of a distribution plan. This plan will likely involve the distribution of any remaining assets or funds related to the NFTs.

Penalty Payment Schedule :

The $750,000 civil penalty will be paid in the following installments:

- $350,000 due within 14 days of the order.

- $200,000 to be paid by December 31, 2024.

- $200,000 to be paid within 12 months of the order.

The company has neither admitted nor denied the SEC’s allegations but has agreed with the settlement terms.

Context and Broader Impact :

Despite this legal action, the Flyfish Club restaurant is set to open its doors on September 20. The SEC’s decision has sparked internal dissent among its commissioners. Commissioners Hester Peirce and Mark Uyeda dissented, arguing that these NFTs should be viewed as utility tokens offering access to dining experiences rather than speculative securities. They criticized the SEC’s approach as overreach and called for clearer guidelines for NFT creators to prevent regulatory confusion.

This enforcement action is part of the SEC’s broader scrutiny of NFT projects, which has also impacted other platforms like OpenSea and Coinbase. The SEC’s aggressive stance has drawn criticism from various stakeholders, including lawmakers and industry experts. There is ongoing debate about the regulatory treatment of NFTs and digital assets, highlighted by recent actions against entities such as Impact Theory and Stoner Cats 2.

Upcoming congressional hearings, including one titled “Dazed and Confused: Breaking Down the SEC’s Politicized Approach to Digital Assets,” will further explore the SEC’s regulatory approach and its implications for the digital asset space. Additionally, Congressman William Timmons has introduced the New Frontiers in Technology Act (NFT Act) to address regulatory concerns and protect NFT creators from excessive SEC intervention.

The Flyfish Club case reflects ongoing debates about how NFTs and digital assets should be regulated, highlighting the need for more defined guidelines in this rapidly evolving sector.