- Bitcoin price falls as the cryptocurrency market fell by 7.79% within a day, reducing the overall value to $2.46 trillion.

- Almost $1.3B in crypto transactions were liquidated, with Bitcoin and Ethereum experiencing the largest losses.

- Investor sentiment is still low, with most retreating due to economic fears and recent global tariffs.

On April 6th, 2025, Bitcoin price dropped 7% to $79,000, a 25 day low. In 24 hours, around $597 million worth of crypto positions were liquidated, and Bitcoin alone accounted for $203 million of the amount. The fall occurred over the weekend when there was slow activity, and it is due to increasing concern over issues that are impacting global trade.

Bitcoin Price Action, April 6, 2025, Source: CoinMarketCap

A week ago, Bitcoin price climbed to 86,000 dollars when China issued a 34 percent tariff on U.S. imports. A few investors fled to crypto, believing that it was safer than the U.S. stock market, which was struggling at that time. However, by Friday, the rise did not continue, and prices began declining again.

Leading Cryptos Decline

Decline started once the U.S. markets closed with fewer people trading in crypto. This gave sellers more control, and Bitcoin began to drop rapidly. It dropped below a crucial price level of 80700 dollars, which had been holding it up, and now some believe it may drop further to 76000 dollars unless buyers intervene in the near future.

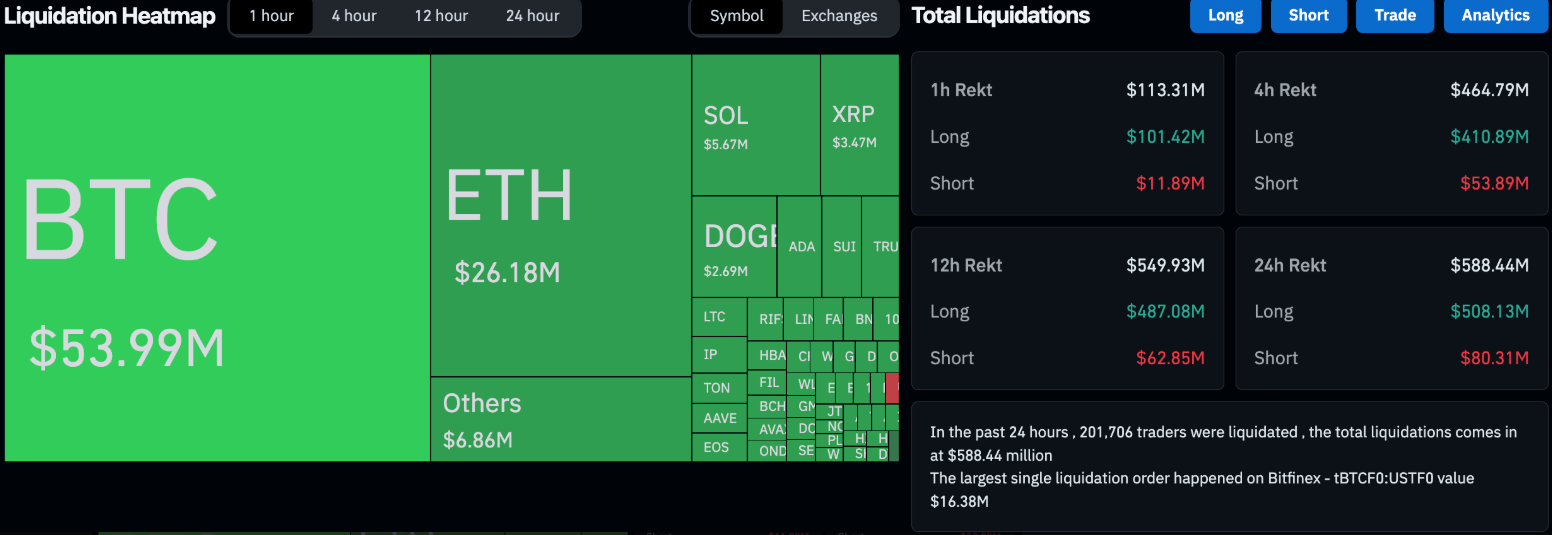

Ethereum saw $164 million in liquidated trades, while other coins like Solana, XRP, and Dogecoin also faced significant losses. Out of the total $514 million, most came from traders who were betting on prices to rise, but the market moved in the opposite direction.

Traders Grow Uncertain

All of this took place during growing trade concerns, especially after former President Donald Trump introduced new tariffs that impacted market sentiment. For a short period, Bitcoin appeared stable even as stocks declined, but the weekend reflected a different outcome.

Crypto Market Liquidation, April 6, Source: Coinglass

Statistics by Coinglass indicate that more than 205000 traders were impacted, and the sentiment is tense as the new week begins. The aggregate worth of the crypto market has declined, and investors are waiting to see if Bitcoin price will continue to stabilize or if more losses are in store. It shows how rapidly a market can turn when volumes of trading decline and large economic news stories are announced.