April 9, 2025, saw a lot of trading activity in the crypto market because of problems with international trade, new policy, and announcements. From China’s imposition of new taxes on imports to the fluctuating price of Bitcoin. A simple summary of what happened and how it’s linked to cryptocurrencies.

Trade Issues Rise: China’s New Tax on Imports

China imposed an 84% tariff on products from the U.S. in retaliation to a 104% tariff imposed by the U.S. on Chinese goods. This conflict is making investors worried, and cryptocurrencies were badly affected.

When nations quarrel over trade, individuals tend to divert funds away from investments such as crypto, and this is why today’s price fluctuations occurred.

China’s central bank also requested big banks to restrict purchases of U.S. dollars to prop up their currency, the yuan. A weaker yuan might assist China in selling goods overseas, but it’s creating uncertainty in markets, including crypto.

Bitcoin Price Drops

Bitcoin, the best known cryptocurrency, dropped below $75,000, losing 6% of its value within one day. This is because trade issues influenced investors, and when stock markets in countries such as Japan and the U.S. dropped, prices of crypto also dropped.

Crypto trades worth approximately $400 million were closed, primarily by individuals who expected prices to increase. Investors are more cautious regarding Bitcoin now, but some expect that this might be a short term problem if trade negotiations get better.

Asian Stock Markets Fall

Asian stock markets had a bad day. Japan’s leading stock index, the Nikkei 225, fell more than 3% to 32,010.93, as technology stocks such as Tokyo Electron declined in value. China’s stock indexes, including the CSI 300 and Shanghai Composite, also declined, as did Hong Kong’s Hang Seng.

When stock markets are down, cryptocurrencies tend to follow, as both are regarded as riskier investments. Issues relating to trade matters are causing individuals to opt for safer alternatives such as cash, impacting the crypto market.

Trump’s Crypto Vision for America

In America, President Trump desires to make America the leader in cryptocurrencies.

His staff, under Bo Hines’ leadership, is making efforts to eliminate outdated regulations that stunted crypto development and is preparing for a new law known as the STABLE Act to fund stablecoins, which are cryptocurrencies linked to such things as the dollar. There’s also talk of a national digital asset reserve.

These concepts may benefit the crypto space, but issues related to trade are causing uncertainty surrounding the timing of their occurrence.

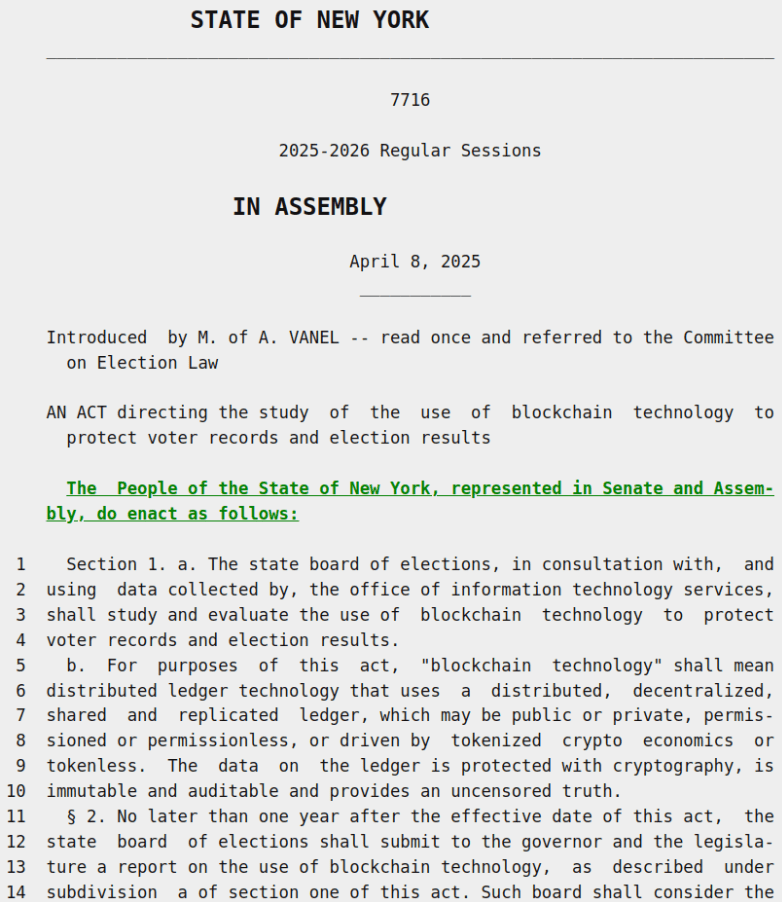

New York Explores Blockchain for Voting

In New York, Assemblymember Clyde Vanel proposed a bill to investigate the use of blockchain technology in elections. Blockchain’s secure records would make voting more trustworthy. The state will research this for a year and report back.

Bill text. Source: New York State Assembly

This doesn’t have a direct impact on crypto prices, but it’s significant for the crypto market because it indicates blockchain being considered for serious applications such as elections. If it works, it would help build trust in blockchain, which could help cryptocurrencies in the future.

Mastercard and Kraken Provide New Crypto Payments

Mastercard and the cryptocurrency exchange Kraken revealed a partnership to enable individuals to use cryptocurrencies at more than 150 million merchants globally.

They will begin with debit cards, physical and digital, in Europe and the UK. This is important for the crypto market because it makes cryptocurrencies more convenient to use for daily purchases, such as food or clothing. Kraken CEO David Ripley and Mastercard’s Scott Abrahams stated that this will make crypto more useful and secure for everyday use.

Shaquille O’Neal Resolves NFT Issue

Basketball legend Shaquille O’Neal has settled a lawsuit regarding his Solana based Astrals NFT project for $11 million. Individuals who purchased these NFTs or related tokens from May 2022 to January 2024 alleged O’Neal marketed them as investments without complying with legal guidelines.

This is an indication that the crypto market is getting more attention from regulators, particularly NFTs, which are less in demand now. It could make investors think twice before investing in new NFT projects.

Ukraine Offers Cryptocurrency Taxes

In Ukraine, the government proposed fresh tax regulations for cryptocurrencies. They wanted to tax cryptocurrency gains of up to 23%, but mining and staking, which serve to operate crypto networks, would be exempt from additional sales tax.

They are observing what other nations tax cryptocurrencies and wish to raise funds for defense purposes. This is important for the crypto market because clear rules can bring in crypto companies, but high taxes might scare some traders away.

Binance Enhances Trading Options

Binance, one of the most popular crypto exchanges, will discontinue six trading pairs on April 11 due to less popular ones such as ACT/BRL and ALPHA/BTC. This is just part of their normal process to maintain the platform’s efficiency.

The coins were not going to cease being tradable; instead, they will be tradable in other forms. News of this slight adjustment for the crypto industry shouldn’t catch traders off guard.

Bitcoin ETFs See Money Flow Out

Bitcoin exchange traded funds (ETFs), which allow individuals to invest in Bitcoin via stock markets, had $224 million drain out on April 8, breaking a four day streak of money pouring in. Grayscale’s GBTC fund experienced the biggest outflow at $303 million, although some funds, such as Bitwise’s BITB, still took in money.

Strategy Considers Selling Bitcoin

One firm, Strategy, stated it could have to sell all of its 528,185 Bitcoins to settle debts. They acquired the coins at an average cost of $67,458, but with the price of Bitcoin declined, they are looking at a $4.6 billion loss.

So much Bitcoin sold could reduce prices on the crypto market. This is a problem for a firm that intended to keep its crypto, and it has investors concerned whether others will do the same.

XRP and ETF Prospects

XRP, the token associated with Ripple, fell 8% to around $1.77 during the market’s fall. There remains speculation of a potential XRP ETF, which would allow investors to purchase XRP through stock exchanges. Some believe approval could occur as late as 2025 if Ripple settles its legal disputes with regulators. An ETF would attract more funds to XRP and the crypto space, but as of now, it is unclear.

What’s Next for Crypto

Today’s crypto market is seeing different developments. Trade problems and tax concerns are bringing prices down, with Bitcoin’s fall showing how global events affect the crypto market.

On the other hand, new ideas are growing as Mastercard works on crypto payment cards and New York tests blockchain for voting. Trump’s support for crypto in the US brings hope, though trade issues might slow things down.

As both challenges and progress continue, it is important for investors to stay informed and prepared. Those who follow the changes closely may benefit the most.

Also Read: Crypto Taxes in 2025: What You Need to Know