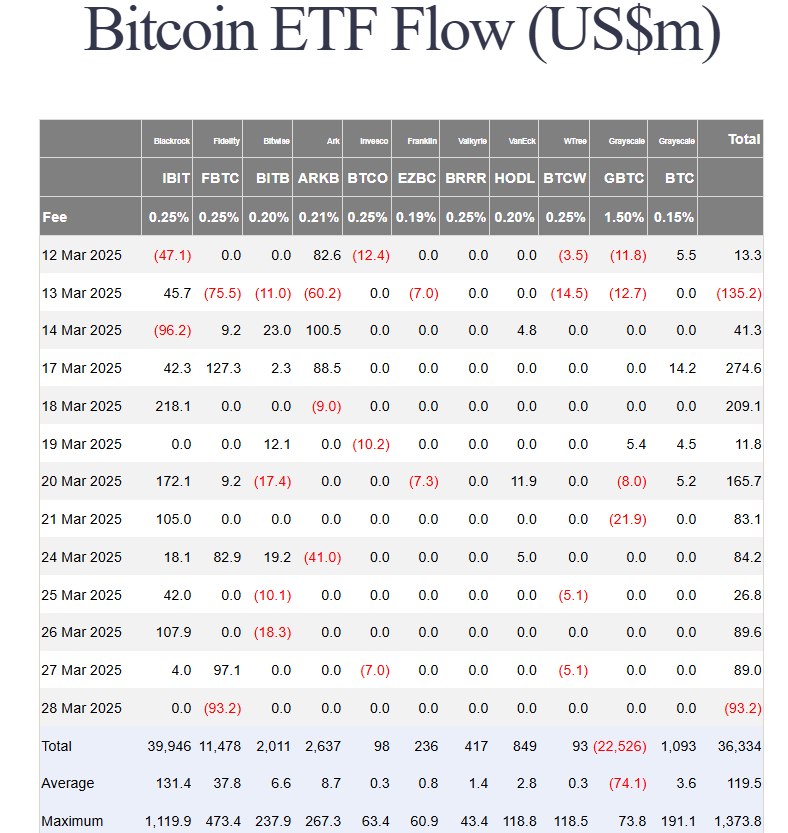

- Spot Bitcoin ETFs in the US had a steep decline in net inflows, down by 73.6% compared to the last week, and Friday witnessed a turn to net outflows.

- BlackRock’s IBIT and Fidelity’s FBTC topped the inflows, followed by numerous other ETFs such as ARK 21Shares and Bitwise, which experienced large outflows.

- Bitcoin’s third-quarter performance is likely to be its worst since 2018, with market uncertainty intensifying in anticipation of US tariffs and doubts surrounding postponed Federal Reserve rate cuts.

Spot Bitcoin ETFs in the US saw a significant decline in net inflows in the past week, ending a 10-day run of successive positive flows that had attracted about $1.07 billion.

Figures indicate that the 12 spot Bitcoin ETFs attracted $196.48 million in net inflows, a massive 73.6% decline from last week’s $744.35 million.

The week started with steady inflows of $84.17 million on Monday, followed by $26.83 million, $89.57 million, and $89.06 million for the next three days. But then came a sudden change on Friday when the ETFs saw net outflows of $93.16 million.

Major Bitcoin ETFs and Their Performance

Most of the inflows went into BlackRock’s IBIT, which increased by $172 million, and Fidelity’s FBTC increased by $86.8 million. VanEck’s HODL also had $5 million in inflows.

Not all ETFs, however, had a positive week, as ARK 21Shares’ ARKB, Bitwise’s BITB, WisdomTree’s BTCW, and Invesco’s BTCO saw a total of $67.4 million in outflows. Some ETFs didn’t move at all during the week.

The Friday outflows also ended the longest inflow run of the year. Analysts noted that while there is demand for Bitcoin, investors are not showing high confidence. The fall in inflows came as Bitcoin’s quarterly performance is turning out to be its worst since 2018, when prices fell by 49.7%.

Bitcoin’s Quarterly Struggles

So far this quarter, Bitcoin has lost 11.86%, which is worse than the 10.83% loss in Q1 2020. Marginally recovering prices can lead to a lower loss compared to 2020, but should selling pressures increase, Bitcoin can drop below $80,000.

The recent drop wiped out almost all of Bitcoin’s weekly gains as investors remained cautious of the impending U.S. tariffs that are set to take effect on April 2.

In the meantime, better economic data have raised concerns that the Federal Reserve will delay interest rate cuts, adding to market uncertainty.

Also Read: California’s New Bill AB-1052 Empowers with Self Custody.