Avinash Shekhar, the CEO of Pi42, explained simple and direct viewpoints in an ET Markets Livestream conversation regarding why this change is happening, how it works, and what the future for India’s cryptocurrency market holds.

India’s cryptocurrency sector is undergoing major changes in 2025, with futures trading increasingly becoming the preferred choice for a majority of market traders.

Spot trading, or where individuals buy cryptocurrency and take direct possession of it, is falling out of favor because of heavy taxation and withdrawal problems. Futures trading, however, enables traders to forecast future prices without holding the assets.

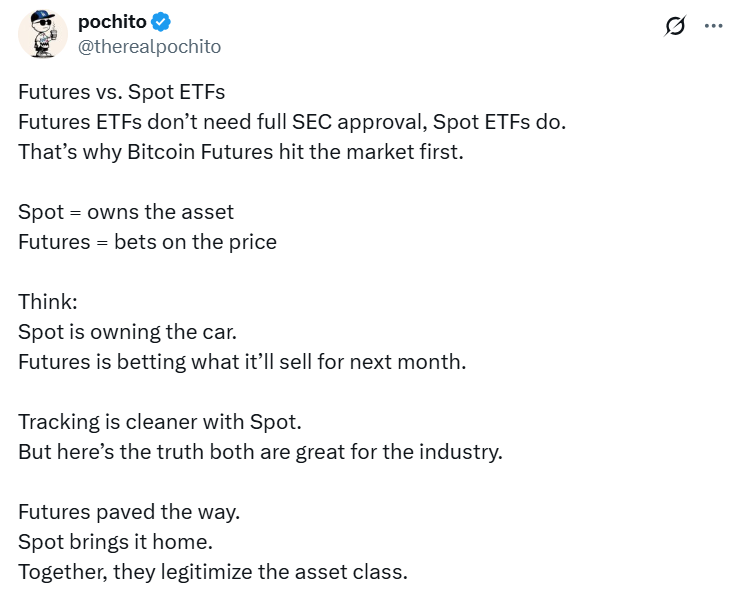

What Is the Difference Between Spot Trading and Futures Trading?

Avinash Shekhar described futures trading as prevalent in the stock market like forecasted future stock price for a Reliance Industries share.

In spot trading, an individual purchases a share and brings it home at once. Futures trading means promising to purchase or sell at a predetermined price in the future, hoping that the value will rise within one to three months. Traders may opt to buy, hoping for a rise, or sell, hoping for a fall, which is not easy in spot trading.

In India, futures and options are extensively applied to stocks. For cryptocurrencies, he pointed to a unique characteristic referred to as perpetual futures, where there is no expiration date and traders can hold their positions indefinitely, in contrast to stock futures that have expirations such as March 28.

Why Is Crypto Futures Trading Becoming More Popular Than Spot Trading in 2025?

Avinash Shekhar Expresses Emergence of Crypto Futures in India explained two primary reasons for the increasing popularity of futures trading in 2025.

Firstly, as markets mature and evolve, professional traders like futures, a trend observed in stock markets across the globe and now in cryptocurrencies in India and around the world.

Secondly, India charges high taxes on spot trading, such as a 1% tax deducted from every trade and a 30% tax on gains, without any provision to offset taxes with losses. This has diminished spot trading volume, driving traders to futures, which avoid these taxes.

He added that Bitcoin’s price increased from $30,000 to $100,000 last year and is currently about $85,000, enabling Indian traders to capitalize on this growth in futures without being burdened by taxations.

How Do Leverage and Low Capital Requirements Make Futures Trading More Attractive Than Spot Trading?

Avinash Shekhar Expresses Emergence of Crypto Futures in India explained leverage as a mean to amplify trading force with limited no. of finances. In futures, traders can begin with 1x leverage, the same as spot trading, or up to 75x. Traders like most usually use 3x to 6x for week or month long trades, involving less startup funds than in spot trading.

This portability allows traders to choose how much risk they want, making futures a attractive option for gaining more returns with less capital.

What Are the Principal Regulatory Issues Impacting Spot Crypto Trading in India?

Avinash Shekhar noted that India’s regulatory advancements are slower than those of nations such as the United States, whose support for cryptocurrencies is more stable.

Even so, there has been some improvement, including the Supreme Court reversing a banking ban, the government leaning toward regulation over banning, more explicit tax regulations even if they are rather high, and exchanges being asked to report under anti-money laundering legislation. Yet, the rigid tax regulations around spot trading keep traders from futures.

Are There Any Other Benefits Besides Tax Efficiency?

Apart from avoiding taxes, Avinash Shekhar Expresses Emergence of Crypto Futures in India highlighted Pi42’s functional design. Unlike spot trading that involves the purchase of stablecoins and withdrawal challenges, Pi42 presents futures trading in Indian rupees outright, like Bitcoin with INR, which encompasses more than 260 choices.

They also trade Bitcoin with USDT using rupee margines with all settlements in INR. A simple and local solution, only available on Pi42 in India, makes trading easier and more convenient.

When Trading Futures, Do Traders Need to Concentrate on Volume or Particular Moving Averages When Buying or Selling?

Avinash Shekhar Expresses Emergence of Crypto Futures in India described how cryptocurrency markets react well to technical indicators since they are newer and less stable than the stock market.

Quick traders typically employ 10 or 25 period moving averages, buying when prices cross above these averages and selling when they cross below. Pi42 substantiates this with no commission on trades closed in 15 minutes, and certain traders utilize automated software to do these quickly.

What Are the Crypto Futures Trading Risks, and How Can a Trader Deal with Them?

Avinash Shekhar Expresses Emergence of Crypto Futures in India said that leverage in futures can increase both gains and losses, so handling money wisely is very important. He recommended funds division, including applying 5% to 10% of funds for highly risky trades and 70% to 80% for comparatively less risky trades with 3x to 5x leveraging, in order to ensure stability and limit chances of losses.

What Type of Participation Are You Observing from Retail Investors Compared to Institutions?

Avinash Shekhar Expresses Emergence of Crypto Futures in India pointed out that cryptocurrency trading in India is mostly dominated by individual retail traders and experienced professionals utilizing analysis tools.

Institutional participation in the form of large organizations is a rare sight because they wait for clearer regulations, as opposed to global markets where institutional participation is increasing. This indicates India is still lagging behind in this regard.

Is There a Plan to Add Options for Improving Strategy Development?

In the future, Avinash Shekhar Expresses Emergence of Crypto Futures in India revealed that Pi42 is working on adding options trading, which will be available in three or four months. Similar to their futures, these will be traded in rupees, allowing traders to buy or sell with lower risk and the opportunity to manage their investments or aim for potential gains, which may encourage wider participation.

Avinash Shekhar explained why futures trading is leading the way in India’s crypto market in 2025. It helps avoid heavy taxes, offers leverage, and is made easier with Pi42’s rupee-based system. Spot trading is slowing down, risks need careful handling, individual traders are in control, and crypto options are coming soon. India’s crypto market is changing, even as rules develop slowly.

Also Read: Are Bitcoin ETF Inflows Drying Up? What’s Next for the Market?