Arkham Intelligence, a prominent player in blockchain data analytics, has recently captured attention with its revelation about Bhutan’s impressive Bitcoin holdings. According to Arkham data, the Kingdom of Bhutan now owns 13,011 Bitcoin, worth approximately $780 million. Known for their sharp insights into blockchain data.

Arkham has shed light on how Bhutan, a small South Asian kingdom, has built up a significant store of Bitcoin. Unlike many government Bitcoin holdings, which often come from asset , Bhutan’s impressive reserves are the result of its own extensive mining efforts.

Bhutan’s Bitcoin Holding :

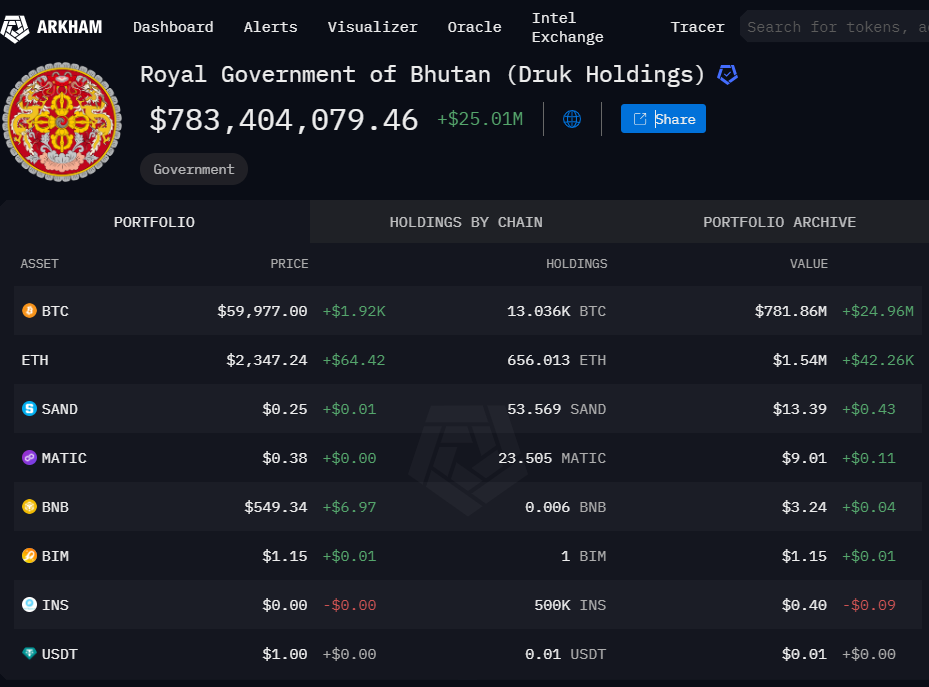

According to Arkham’s analysis, Bhutan holds a remarkable 13,092 BTC, valued at approximately $784.54 million. This positions Bhutan as the fourth largest government Bitcoin holder on Arkham’s platform. Unlike many government-held Bitcoin reserves, which often originate from law enforcement asset seizures, Bhutan’s Bitcoin is derived entirely from its own mining activities. This distinction underscores Bhutan’s unique approach to accumulating cryptocurrency.

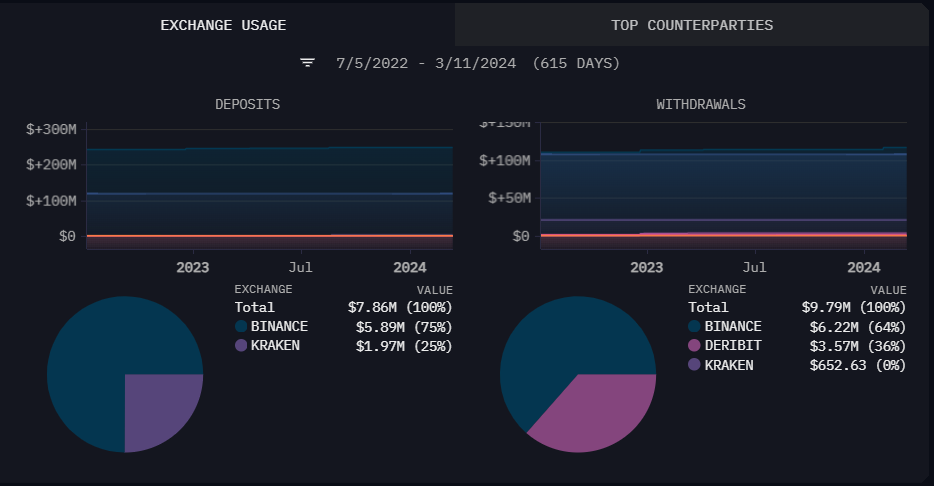

Arkham’s role has been pivotal in identifying and tracking Bhutan’s Bitcoin holdings. The firm’s analysis is supported by time-lapse satellite imagery, which has been used to verify the timeline of on-chain mining activities in relation to the construction of mining facilities. This meticulous tracking process offers a comprehensive view of how Bhutan’s Bitcoin reserves have grown over time

Arkham’s public disclosure of Bhutan’s Bitcoin holdings provides valuable insights into the kingdom’s strategic use of its natural resources. By leveraging its abundant hydropower, Bhutan has established a 100% carbon-free Bitcoin mining operation. The firm’s findings highlight Bhutan’s commitment to eco-friendly practices and its emerging role as a significant player in the global cryptocurrency market

Royal Government of Bhutan (Druk Holdings) :

Bhutan’s approach to cryptocurrency is notably different from other governments. While many government-held wallets contain confiscated assets, Bhutan’s Bitcoin and crypto holdings are the result of mining operations. With a total crypto portfolio valued at over $750 million, Bhutan’s strategy reflects a significant and strategic investment in digital assets.

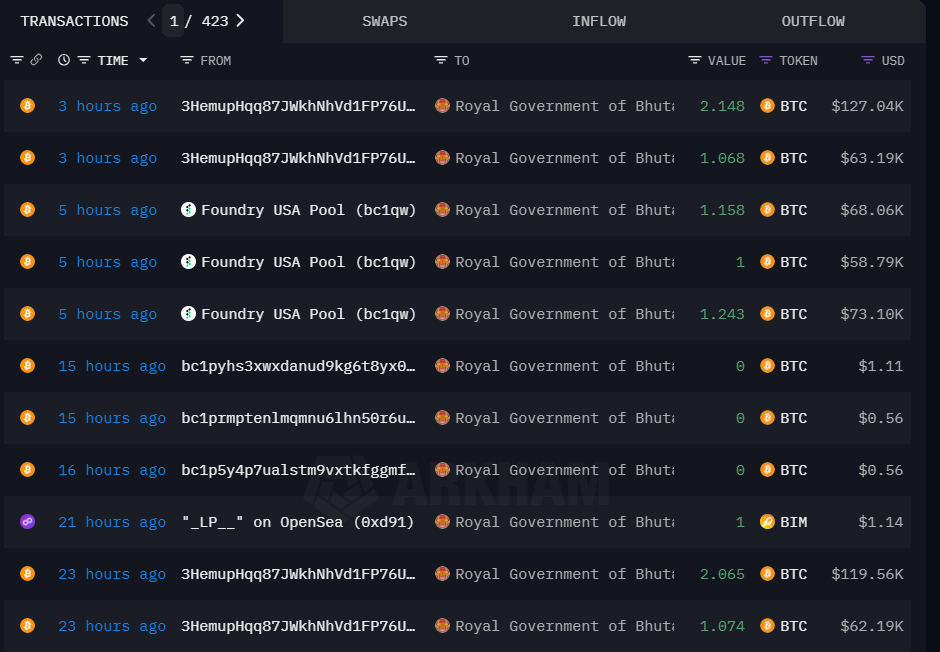

Druk Holdings, Bhutan’s investment arm, manages the mining operations, which generate regular block rewards of 1 to 5 BTC per day. In May 2023, Druk Holdings, Bhutan’s state investment arm, teamed up with Bitdeer, a major Singapore-based mining firm, to launch a 100% carbon-free Bitcoin mining operation. This partnership led to a rapid increase in Bhutan’s mining activities, with an initial 100-megawatt facility established and plans to expand to 600 megawatts by 2025.

Alongside its significant Bitcoin holdings, Druk Holdings also manages a portfolio that includes 656 ETH, valued at around $1.5 million, and other digital assets like BNB and MATIC. Bhutan’s strategic interest in cryptocurrencies goes further, as the country is also exploring the development of a central bank digital currency (CBDC), reflecting its broader ambition to integrate digital assets into its financial ecosystem and drive economic growth.

Beyond mining, Druk Holdings invests in diverse sectors, including AI, drone technologies, and infrastructure projects. Despite previous dealings with companies like BlockFi and Celsius, Bhutan emphasizes self-custody and avoids high-risk assets.

When compared to other government Bitcoin reserves, Bhutan’s holdings are significant but not among the largest. For instance, the UK government holds 61,245 BTC, and the US government retains 203,239 BTC. Bhutan’s strategic and environmentally conscious approach to crypto mining positions it as a notable player in the cryptocurrency world.

Conclusion :

Arkham Intelligence’s detailed tracking and reporting on Bhutan’s Bitcoin holdings underscore the kingdom’s innovative and eco-friendly approach to cryptocurrency. By wisely using its natural resources and making smart investments, Bhutan has become an important and forward-thinking player in the global crypto market.