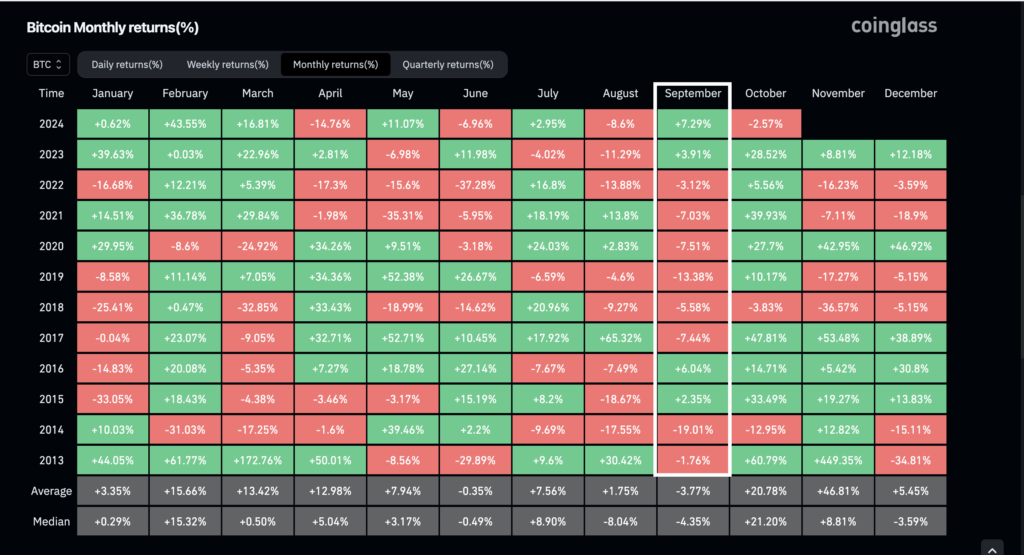

Bitcoin Monthly Returns : September has often been a tough for Bitcoin Monthly Returns, filled with drops and market uncertainty. However, this year was different. Instead of the expected struggles, Bitcoin surprised everyone with a 7.35% gain, making it the best September ever. This impressive rise energized the crypto market, especially since September usually has a reputation as Bitcoin’s worst month.

Historical Bitcoin Monthly Returns

Source : Coinglass

Bitcoin Monthly Returns in September 2024 stood at $63.6k, breaking its previous September high of $43.8k set in 2021. Not only did this mark the highest September closure ever, but it also made this month the third-highest monthly close in Bitcoin’s entire history. For investors, this has been an exciting development, especially considering Bitcoin’s usual performance in September, which has historically been in the red.

Reasons for the Rise

Several factors drove this unexpected rally. First, the Federal Reserve surprised markets by cutting interest rates by 0.5%, supporting both traditional and crypto markets. Additionally, China injected large amounts of money into its economy, pushing Bitcoin’s price higher. These two economic decisions had a big impact on Bitcoin’s strong performance, especially in the last two weeks of the month.

New capital entering the crypto market also played a key role. In the U.S., Bitcoin ETFs saw record inflows of over $1.1 billion in September, showing growing confidence from institutional investors, which has become crucial for Bitcoin’s price growth.

Spot On-Chain Prediction

The on chain data analytics platform Spot On Chain also played a role in Bitcoin Monthly Returns. Utilizing AI models, Spot On Chain accurately predicted the bullish trend in September. Their forecasts show optimism for the upcoming months as well. The platform estimates a 69% chance that Bitcoin could hit a new all time high in October and a 54% chance of reaching $100,000 by the end of the year.

A key technical indicator supporting this prediction is Bitcoin’s exit from the Gaussian channel, a rare occurrence in the cryptocurrency’s history. This exit has only happened twice before, both times signaling strong future growth. With these indicators in mind, many investors are entering the fourth quarter with revived hope.

October Builds on September’s Thurst

As Bitcoin enters October, the positive momentum from September continues. In the first few weeks of October, Bitcoin has already gained around 12%, supported by China’s stimulus announcement and a steady flow of newly mined Bitcoin into U.S.-listed spot ETFs. From a low of just under $58,000 in mid-September, Bitcoin’s price climbed above $64,000 by the end of the month, creating a foundation for further growth.

This growth, however, hasn’t been without its challenges. On September 18, the Federal Reserve’s rate cut caused Bitcoin’s price to increase by 13.8%, reaching $65,800, bringing it within 10.8% of its all-time high of $73,734. Institutional interest remains high, but some risks still exist in the market.

Challenges and Resistance

Even with the recent positive view, challenges remain. Demand for stablecoins in China is low and Global Geographical tensions, which could be a bad sign for the overall cryptocurrency market. While Bitcoin is strong, it is still about 13% below its all-time high, and analysts warn that reaching a new record may take longer than expected.

In technical terms, Bitcoin faces important resistance levels. The $70,000 mark is a strong barrier, with Bitcoin staying around $60,000 for several months. If Bitcoin breaks through the $65,500 resistance, it could rise to $67,000. If it fails, however, the price could drop to critical support at $63,500, with a larger decline potentially sending Bitcoin down to $50,000.

A Bullish but Cautious Market

The Relative Strength Index (RSI) shows positive momentum, suggesting that Bitcoin could soon break through its current resistance levels. However, market analysts are careful. If Bitcoin goes above the $70,000 mark, we could see a lot of price changes, possibly pushing the price to new highs. If it fails at this level, the $61,000 support will be important to prevent further drops.

Overall, September was a turning point for Bitcoin investors, as the cryptocurrency achieved its best monthly gains ever. With a solid foundation as we enter the fourth quarter, Bitcoin has the chance to keep rising, but important resistance levels and market uncertainties remain. For now, the market is hopeful, with investors closely watching Bitcoin’s record breaking run.

Conclusion

To sum up, 7.35% Bitcoin Monthly Returns in September has created an exciting perspective for Q4. While the market shows positive signs, investors should be watchful as Bitcoin nears important resistance levels. Whether it can reach new all-time highs or face another break, one thing is clear, Bitcoin’s performance in September has surprised the bears and given hope to the bulls for what is to come.