- As geopolitical tensions and trade wars create uncertainty in conventional markets, investors might find shelter in decentralized, non sovereign assets such as BTC that are not subject to government controls or sanctions.

- Trade wars tend to create inflation or currency depreciation, particularly in developing economies. As the national currencies depreciate, Bitcoin becomes more appealing as a hedge, increasing demand and price.

- In spite of macroeconomic instability, the underlying institutional adoption of BTC by institutions, payment platforms, and nation continues to expand offering bullish fundamentals regardless of international trade patterns.

Tariff’s Impact On Bitcoin Market

Bitcoin, Cryptography and equities traders had expected a eleventh hour resolution to avoid the US imposing 104% tariffs on imports from China into the United States, but in a press briefing, the White House assured that the tariffs will begin from April 9. The markets worsened when Peter Navarro, the trade adviser of US President Donald Trump, said that tariffs were “not a negotiation.

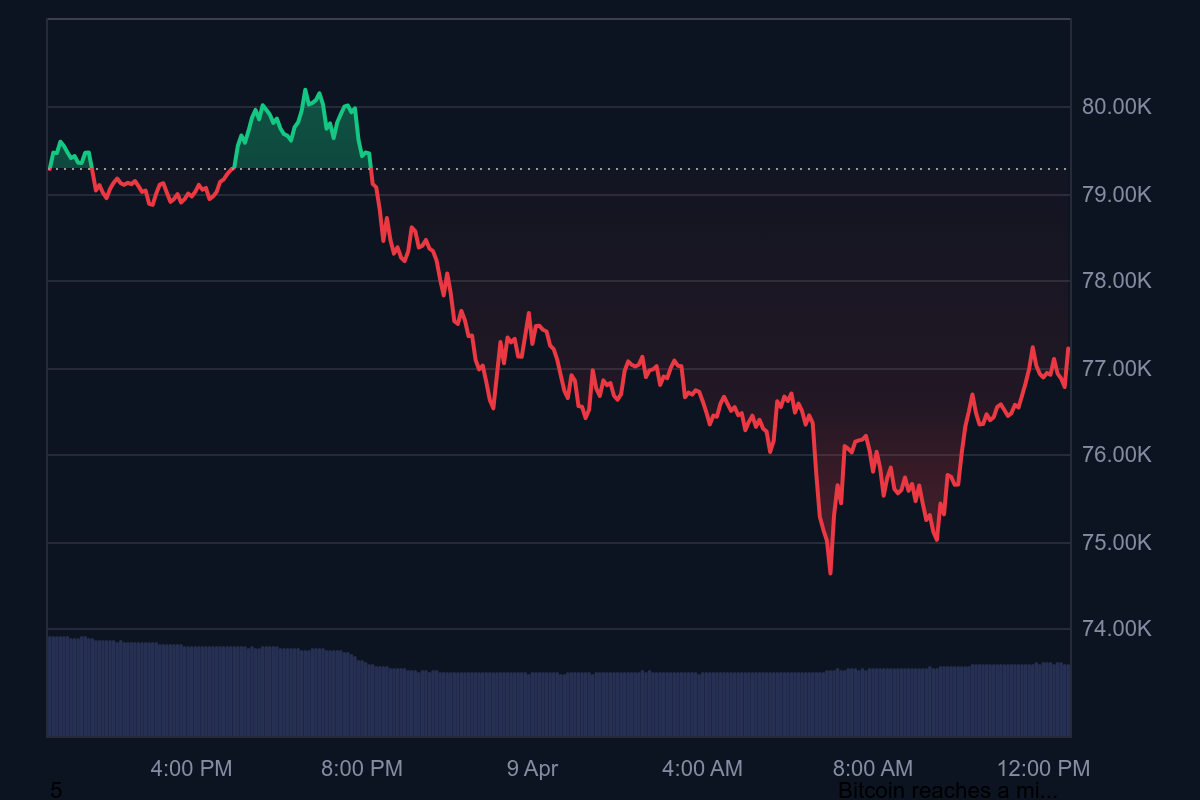

From April 2 to April 7, the S&P 500 index fell by 14.7%, triggering panic among Bitcoin owners and compelling a retest of the $75,000 mark the lowest in over five months.

In an April 7 appearance with Israeli Prime Minister Benjamin Netanyahu, President Trump was quoted as saying his objective was to “reset the table” on trade. He said that “there can be permanent tariffs, and there could also be negotiations because there are things that we need beyond tariffs.

It is apparent that the stock market will recover if trade war tensions ease. Economists have warned that tariffs will lead to inflation and increase the likelihood of economic recession considerably, as per Reuters. Nevertheless, determining the price impact on BTC. is still a difficult task to accomplish. That is due to the fact that some investors regard the cryptocurrency’s fixed monetary framework as protection from the perpetual growth of global fiat currency supplies.

Expectations On BTC Bull

The strong positive relationship between Bitcoin and the stock market should continue. Nevertheless, the US government’s budgetary issues hold out a prospect for Bitcoin’s price to appreciate. On April 8, the US 10 year Treasury yield increased to 4.28%, from a brief selloff at 3.90% on April 7. This climb indicates that investors are willing to accept more for holding these instruments.

The higher cost of rolling over the $9 trillion in US government debt due to mature in the next 12 months will contribute to further fiscal imbalance and a weakening of the dollar. The US Dollar Index has decoupled from US Treasury yields, declining to 103.0 on April 8 from 104.2 on March 31. This may be able to prop up the price of Bitcoin a view echoed by BlackRock CEO Larry Fink in his March 31 investor letter.

Bitcoin’s momentum is likely to turn positive as traders realize that the US Federal Reserve has limited tools to avoid a recession without risking inflation. While predicting the exact timing of a breakout remains uncertain, prolonged delays in resolving trade war issues could drive investors toward scarce assets like Bitcoin, especially amid fears of potential US dollar devaluation.

Also Read : Bitcoin Breaks Down To $79K Ahead Of Brutal Market Open