- We are going to Compare and contrast the performance, attributes, and market behavior of Bitcoin and Gold as rival stores of value in 2025.

- Assess the principal drivers of investor sentiment, such as inflation concerns, dollar vulnerability, and central bank gold stockpiling.

- Provide an opinionated viewpoint on the changing roles of Bitcoin and Gold in the contemporary financial system and their implications for global investors.

All Eyes On Bitcoin vs Gold Showdown

As we make our way through 2025, Bitcoin vs Gold debate as the best store of value grows stronger. Both have shown impressive performances, but they appeal to distinct investor types and philosophies.

Gold has traditionally been prized for stability and inherent worth. In April 2025, gold prices rallied to an all time high of $3,430 per ounce, fueled by rising geopolitical tensions and a weakening U.S. dollar. Central banks, particularly China’s, have been adding gold reserves, pointing to a move towards old safe haven assets in times of global uncertainty.

The value of gold has increased by almost 30% since the start of the year, fueled by the U.S, China trade war, political tensions between President Trump and Federal Reserve Chairman Jerome Powell, and fears. Investors are increasingly seeking refuge in gold as a hedge against economic uncertainty, which has led to huge inflows into gold exchange traded funds (ETFs), with $21 billion in the first quarter of 2025.

Bitcoin’s manifests itself through occasional similarities that the currency bears in relation to gold’s price. Historically speaking, as prices of safe haven commodity go up, the status of Bitcoin as the preferred currency rises along with it. However, determining if this tendency will hold fast in the contemporary market scenario becomes a must. Gold is generally a safe haven commodity, while Bitcoin is increasingly being sought after by investors as well, but only time will tell if it will follow the same growth curve of safe haven commodity.

BTC Supremacy Among The Battle Of Bitcoin vs Gold

Bitcoin, commonly referred to as “digital gold,” has been gaining popularity as a new store of value. With a total supply of 21 million coins, Bitcoin provides a deflationary asset that is attractive to investors looking for alternatives to fiat currencies. Bitcoin’s price can be expected to hit between $175,000 and $250,000 by the end of 2025, as indicated by increasing institutional adoption and positive regulatory progress.

Top Posts on Bitcoin vs Gold at X,

The primary reasons for this movement are because investors are looking to seek refuge as an alternative asset due to economic uncertainty. The safe haven asset was the perfect option in the face of current global trade wars and a declining dollar value. Bitcoin is also presently, however, portrayed by some as an increase in value, which further adds complexity to the interdependence between two assets.

Even though there is displayed the same trend upward for both assets, it doesn’t necessarily imply that it will be the same in the future as well. The direction of the market due to the ongoing geopolitical and economic incidents will likely monitored to check whether Bitcoin goes down the same path or not. This is due to the fact that investors and traders are always watching both markets with great interest in case one is divergent from the other in terms of the trend that is being observed.

Over the next few weeks, BTC/GOLD ratio will be an important variable for traders. A shift in this ratio indicates that something large is happening in the market, and it will be good for investors.

The Ultimate Comparison

Bitcoin vs Gold in the modern financial world, the differences are as intriguing as their increasing similarities. Gold, with its centuries long history as a trusted store of value, has been the go to refuge during times of economic upheaval for centuries. Its supply is naturally constrained, its markets are extremely liquid, and it is universally accepted by central banks and conservative investors.

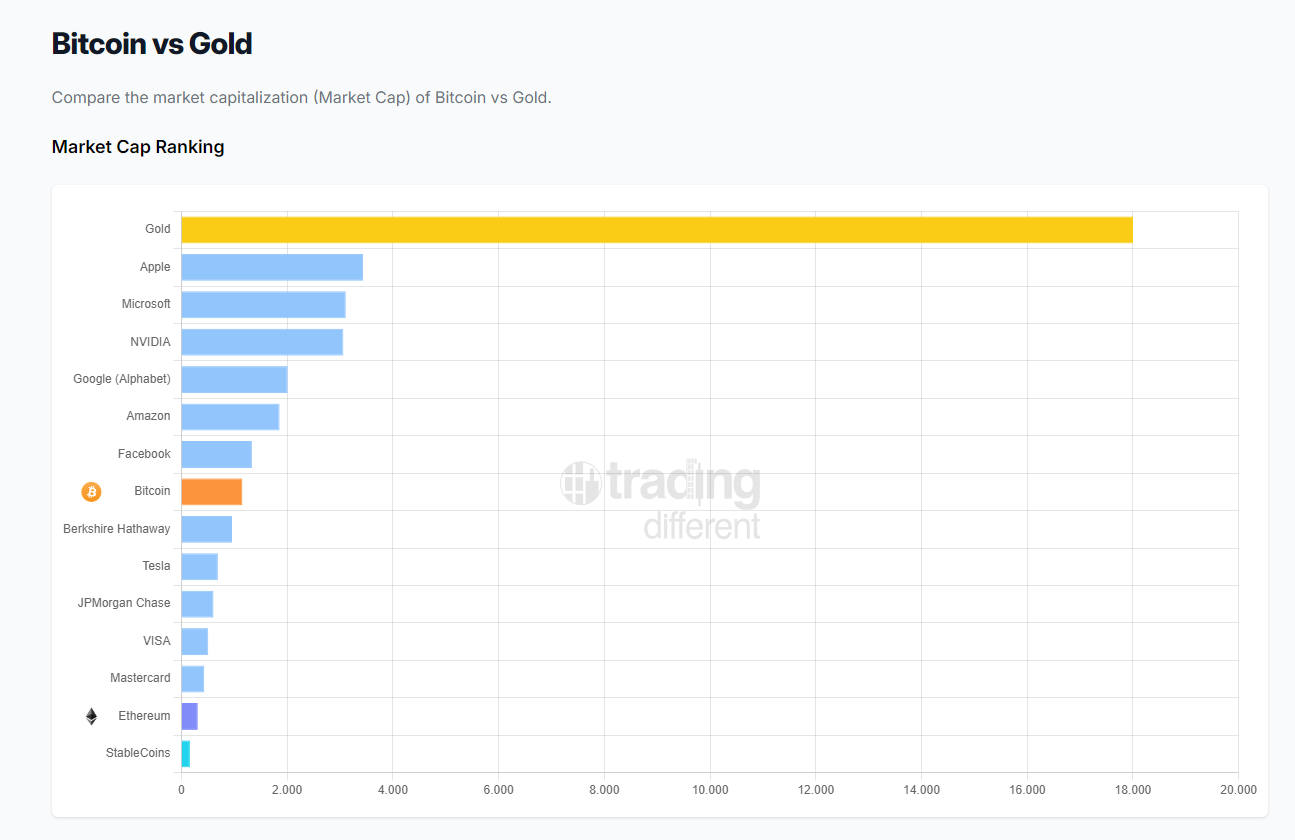

As per Market Cap Ranking chart of Bitcoin vs Gold,

Conversely, Bitcoin, which is only slightly more than a decade old, has established a disruptive presence with runaway growth and unprecedented volatility among the Bitcoin vs Gold Game. Its fixed 21 million coin supply offers a new, digital model of scarcity that appeals to a generation distrustful of fiat inflation. Though Bitcoin’s liquidity is quickly increasing with the spread of exchanges and institutional demand, it is still weighed down by a changing and frequently volatile regulatory landscape.

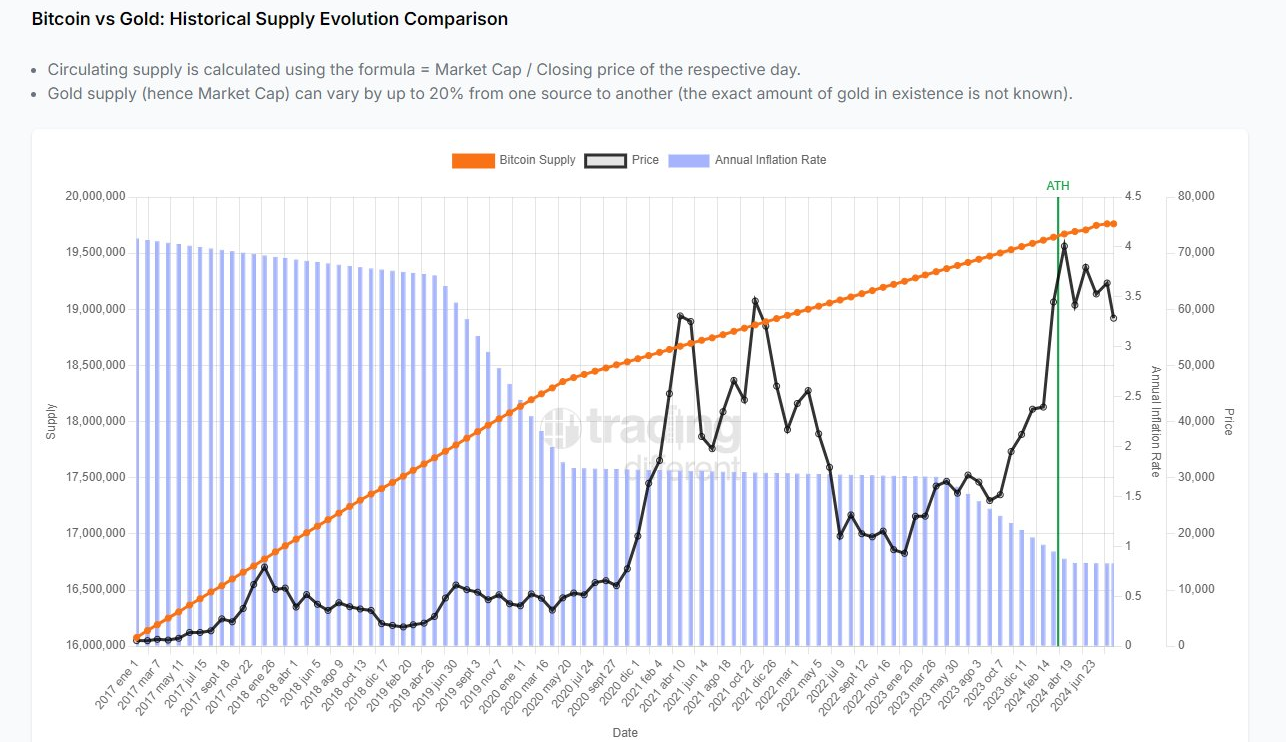

As per Historical Supply Evolution Comparison of Bitcoin vs Gold

But for all that Bitcoin is lacking in terms of historical stability, it more than compensates with unparalleled portability and digital convenience and is thus a strong player in the store of value debate. In my opinion, whereas Gold is currently the stability champion, Bitcoin’s technology edge and growing acceptability indicate that it won’t be a niche challenger for long, it is poised to become a central financial asset in its own right.

Final Thoughts On Bitcoin vs Gold

On this Bitcoin vs Gold in the market, The decision to invest in either gold or Bitcoin depends on the personal investment aim and risk level. Gold presents stability and historical performance, whereas Bitcoin is promising in growth as well as intangible in its form. Each is well fitted to cater to its target investor’s preferred style. In a diversified portfolio, the two assets can serve complementary purposes, merging conventional security with new growth options.

Also Red : Metaplanet’s New Purchase Of 330 Bitcoins to Boost Upto 4855 Holdings