- Bitcoin lingers in a tight range just under its all time peaks, the cryptocurrency market is at a pivotal point of inflection.

- A number of macroeconomic and geopolitical forces are building in the background any one of which could serve as a potent catalyst or an unexpected headwind.

- From tariff delays to potential Fed leadership upheaval, and China’s reversing position to upcoming U.S. rate cuts, the setting is all set for Bitcoin’s subsequent forceful direction.

Does Current Tariff Postponements Calm The Market?

One of the most important geopolitical stories that has been impacting risk assets such as Bitcoin is the constant tariff talks between the U.S. and its principal trade partners. Latest news indicates that some of the scheduled tariffs can be delayed as Washington attempts to dial back tensions and calm inflation.

Tariff pause is usually risk on bull. It might relieve pressure on global supply chains and trade, providing some leeway for equities and crypto alike. It may be short lived, however. If inflation comes back with a vengeance, the Fed might be compelled to remain hawkish for longer, which would clip Bitcoin’s wings in the near term.

China’s Crypto Convo, Can We Expect A Positive Sign?

Another intriguing turn of events is from China’s increasingly softened language regarding crypto. Whereas the nation has been hardline for years, recent state media conversations and regulatory documents suggest a more complex stance, especially with regards to blockchain and cross border payments.

BitMEX cofounder Arthur Hayes recently pointed out that a more welcoming Chinese attitude might create the opportunity for increased institutional capital inflows into crypto from Asia, particularly through Hong Kong’s regulated avenues. Although all out policy changes are speculative, even modestly positive signals from Beijing have the effect of improving market mood as we experienced during earlier Asian driven Bitcoin booms.

The Change Of Fed’s Chair

Maybe the largest wild card on the table is increasing speculation regarding Federal Reserve Chairman Jerome Powell’s tenure. Rumors of a potential replacement have circulated in policy circles and financial press. Although no official action has been taken, the mere uncertainty is sufficient to rattle rate expectations.

If a new, dovish chair were to assume the leadership role, markets would price in quicker rate cuts and a more accommodative monetary policy. Bitcoin, frequently considered a hedge against currency debasement, would be the beneficiary. Conversely, any sense of leadership uncertainty at the Fed would frighten investors and cause short term outflows from riskier assets such as crypto.

Will Rate Cuts Lift Bitcoin Or Drag It Down?

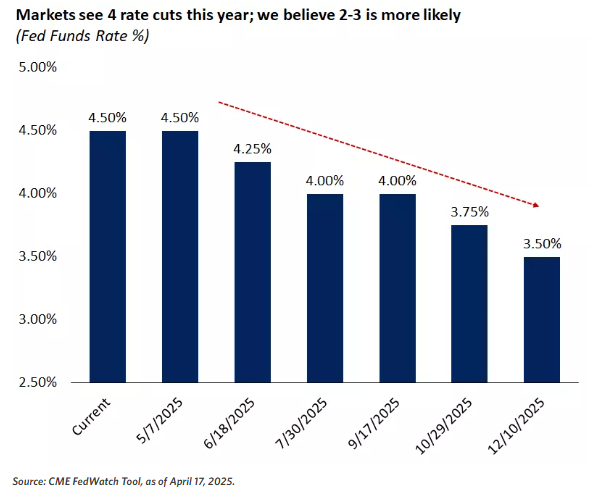

Most analysts believe rate cuts are imminent the only question is when. Downward trending stablecoin inflows, according to on chain data platform CryptoQuant, indicate institutional investors are patiently waiting for outright confirmation before allocating large amounts of BTC.

Concurrently, Vaneck’s Director of Digital Assets Research, Matthew Sigel, said last month that Bitcoin is likely to see fresh highs within a cycle of rate cutting, especially if combined with ETF sourced inflows. Yet in a downturn induced environment for rate cutting, risk off mentality would overwhelm any bearishness from positive monetary policy actions.

Bitcoin’s Next Move Depends on Macro Stability

In my view, the next significant action by Bitcoin won’t be set by an event but by how these conditions all align. In a situation where tariffs are delayed, China stays in a diplomatic mood, the Fed is dovish and names a dovish chairman, rate cuts come amidst stable inflation levels, the resulting perfect storm for Bitcoin to drive through its resistances would make it the key.

On the other hand, if tariff negotiations fall apart, China redoubles efforts on crypto curbs, Fed leadership is put in doubt, and rate cuts are postponed, Bitcoin may test its support levels under added market pressure.

Either way, volatility is on the horizon. And for crypto traders and long term investors alike, remaining well informed and agile will be essential in navigating what is shaping up to be a high stakes summer for Bitcoin.

Expectations For The Upcoming Days

As we pursue further into 2025, Bitcoin is tangled in the crosswinds of macroeconomic forces well beyond the crypto charts. From changing geopolitical tides to Federal Reserve politics and global monetary policy shifts, the future trajectory of the cryptocurrency will be influenced not by singular headlines but by how these multifaceted forces intersect.

Whether these forces unite to power Bitcoin’s next breakout or load it up with fresh volatility, one thing is certain, agility and watchfulness will be the keys to navigating these markets for anyone. Traders and investors must remain firmly attuned to both crypto native and traditional signs, using signals from on chain data platforms such as CryptoQuant and market commentaries from such veterans as Arthur Hayes and Vaneck.

Ultimately, Bitcoin has been tested before and it’s those who stay educated, adaptable, and disciplined who generally come out on top when the dust settles. The coming months may be among the most formative chapters in crypto markets of the past several years.

Also Read : Binance Reveals Powerful New KYC Requirements For 2025