- BlackRock receives UK FCA approval to assist iShares Digital Assets AG in handling crypto ETPs under strict guidelines.

- It can trade ETP and exchange crypto to fiat but cannot onboard customers or keep funds.

- The approval can bring iShares Bitcoin ETP to the UK following its European debut.

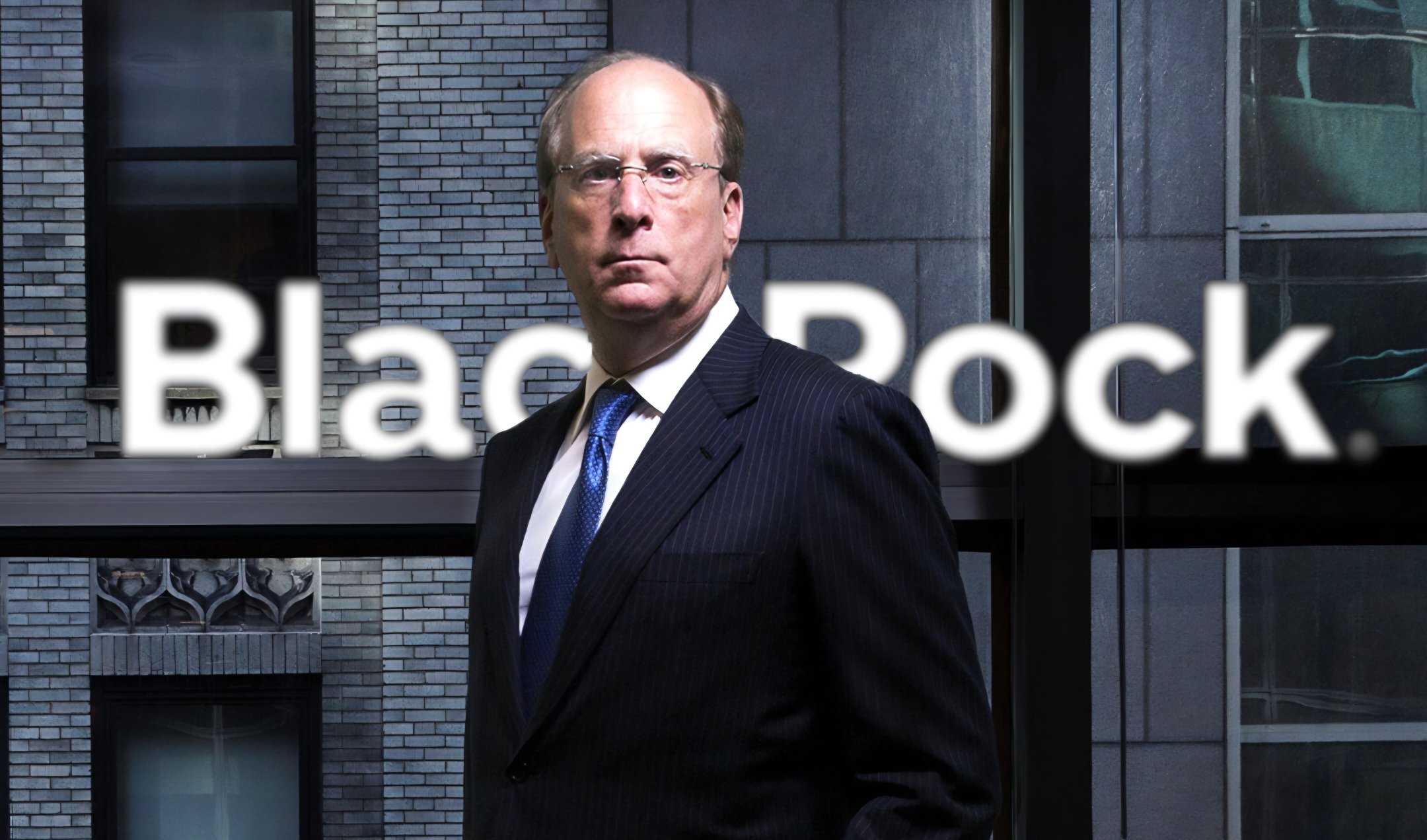

BlackRock has received approval from the UK’s Financial Conduct Authority (FCA) to become a registered crypto asset firm.

This is among the very few firms in the UK qualified to offer services related to cryptos under very strict regulation. BlackRock will now be on the same line as other giant firms such as Coinbase, Kraken, and PayPal, who have all also gone through the FCA’s compliance process.

BlackRock’s Limited Role in Crypto Services

The clearance enables BlackRock to provide backing to its sole client, iShares Digital Assets AG, in managing crypto-linked exchange-traded products (ETPs). These products offer investors exposure to cryptocurrencies without physically acquiring and keeping them.

Yet, BlackRock has a restrictive role. The company can assist in the processing of crypto transactions for ETPs, exchange digital assets for fiat to fund costs, and exchange crypto to fiat for early redemptions when necessary.

However, it cannot onboard new customers or take on funds from customers without FCA’s explicit written consent. It cannot also run machines that convert fiat to crypto or vice versa.

Impact on BlackRock’s iShares Bitcoin ETP

This step may allow BlackRock to bring its iShares Bitcoin ETP to the UK. The company recently brought this product to Europe via the Euronext exchanges in Paris and Amsterdam and Germany’s Xetra exchange. The iShares Bitcoin ETP provides a regulated and secure means for investors to gain access to Bitcoin using conventional stock markets.

In order to appeal to more investors, BlackRock has suspended the product’s fee temporarily to 0.15% for the remainder of the year. The Bitcoin used to back the ETP is held securely by Coinbase in cold storage offline.

BlackRock’s approval is regarded as a huge milestone for institutional interest in crypto. The firm has been growing its presence in the crypto asset market, and its chief executive, Larry Fink, has indicated that Bitcoin can be used as a store of value. With an increasing number of institutional investors looking for safe and regulated means of investing in cryptocurrency, BlackRock’s action strengthens its position within the market.

The FCA continues to remain restrictive in licensing crypto firms, turning down a large number of applications that do not qualify according to compliance levels. Yet it is also available to develop its rules as the market evolves, so that only serious players have the capability of working within the UK’s crypto environment.

Also Read: Will Bitcoin price Hit $250K? Arthur Hayes Reveals the Shocking Truth