- Crypto Taxes come when you sell, trade, or use crypto—rates depend on holding time and income.

- Starting 2025, monitor every wallet; mining, staking, and airdrop income is taxed on the value received.

- Exchanges will report transactions, NFTs could receive higher rates, and services such as CoinLedger avoid fines.

If you’re dabbling in meme coins or jumping into DeFi, knowing your crypto taxes now can save you from trouble later. For years, the U.S. tax folks didn’t pay much attention to crypto, but that shifted in 2019 when they started asking people to report it.

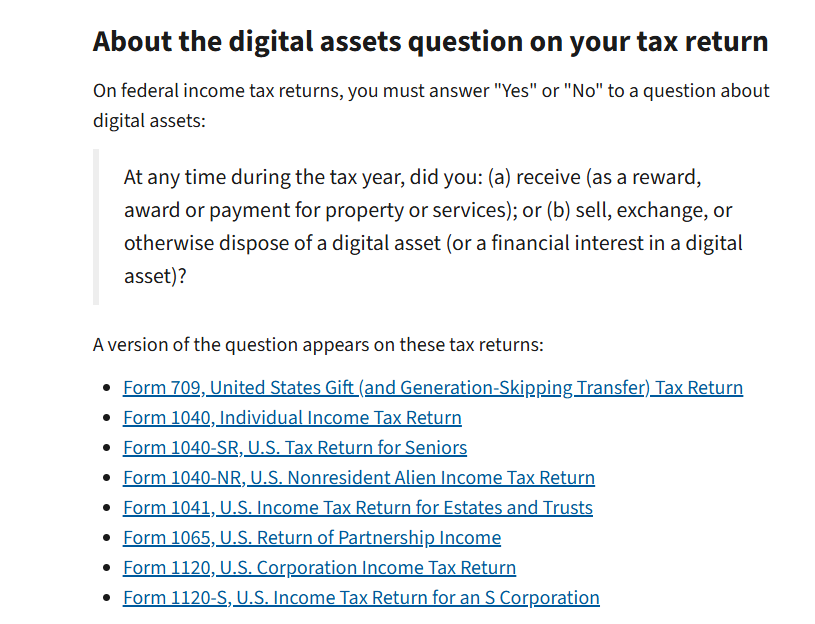

By 2020, a question about crypto taxes, making it clear: if you’re making money with digital assets, you’ve got to tell the government. The IRS said in a post, that “Income from digital assets is taxable.”

The crypto taxes from crypto trading it or using it to buy stuff counts as income you owe taxes on.

This piece will look at how crypto taxes work in 2025, what changes might come with Donald Trump back in charge, and what it all means for folks investing. Whether you’re hoping for big wins or worried about a tax mess, figuring out the rules is key.

When Crypto taxes are taxed?

Buying crypto with dollars isn’t something you pay taxes on right away it’s only when you sell, swap, or spend it that crypto taxes kick in. If you sell and make more than you spent, that profit gets taxed. How much depends on how long you held it: less than a year, and it’s taxed like your regular paycheck; over a year, and you get a lower rate maybe 0%, 15%, or 20%, based on what you earn.

Experts say almost every move with crypto like swapping it for another coin or buying an NFT—needs to be tracked. Starting in 2025, you can’t just lump all your crypto together anymore; you’ve got to keep tabs on each wallet separately. That’s a new rule to make things clearer for the tax folks.

Income From Crypto

Some crypto stuff gets taxed like everyday income, not profits from selling. If you get paid in coins, mine them, earn from staking, grab free tokens from airdrops, or make interest in DeFi, that’s all income. You owe taxes based on what it’s worth the day you get it.

Even little bonuses from games or referrals count. Tracking all this can get messy, especially with tons of tiny trades across different places. That’s why tools like CoinLedger, Koinly, or CPAI are popping up—they help you sort it out and figure your taxes.

New rules in 2025 also mean exchanges have to report your trades, and if you mess up, fines could hit hard think thousands of dollars or worse.

NFTs are trickier they might get taxed like rare collectibles, which means a higher rate if you hold them long. It depends on what they’re tied to, like art or gems. Either way, every NFT move has to be reported. With tougher rules coming, staying on top of your crypto taxes is a must.

Get your records straight, use handy software, and maybe chat with a tax pro to dodge big penalties. Some lawmakers are pushing back, saying old-school rules don’t fit crypto and might scare off new ideas. They’re trying to lighten the load, but for now, playing by the book is the safest bet.

Also Read: BlackRock Gets UK FCA Approval for Crypto, What’s the Strategy Behind It?