- Ethereum price fell to $1594 on April 6, 2025, and declined over 11% in 24 hours as Bitcoin dropped below $77,000.

- More than $164 million worth of Ethereum positions were liquidated, with increased pressure close to the $1554 support level.

- Technical charts indicate Ethereum is oversold, but any recovery will depend on Bitcoin gaining strength.

Ethereum price dropped last weekend of April 6, 2025, which became three weeks low at around 1650 dollars. This followed the fall of Bitcoin below 77 thousand dollars, pulling down the entire crypto markets down with it.

Ethereum [ETH] Price Action, April 6, 2025, Source: CoinMarketCap

Ethereum price lost 11.24% of its price within a matter of only 24 hours landing at 1594 dollars by Sunday. The drop cancelled out gains from previous in the week when Ethereum price had risen above 1770 dollars, Ethereum rose above 1770 dollars after a short rise following China’s response to U.S. trade tariffs. But the growth didn’t last, as Bitcoin fell, which also caused Ethereum and other altcoins to go down.

Ethereum Price Sees Liquidation Build Near Key Support

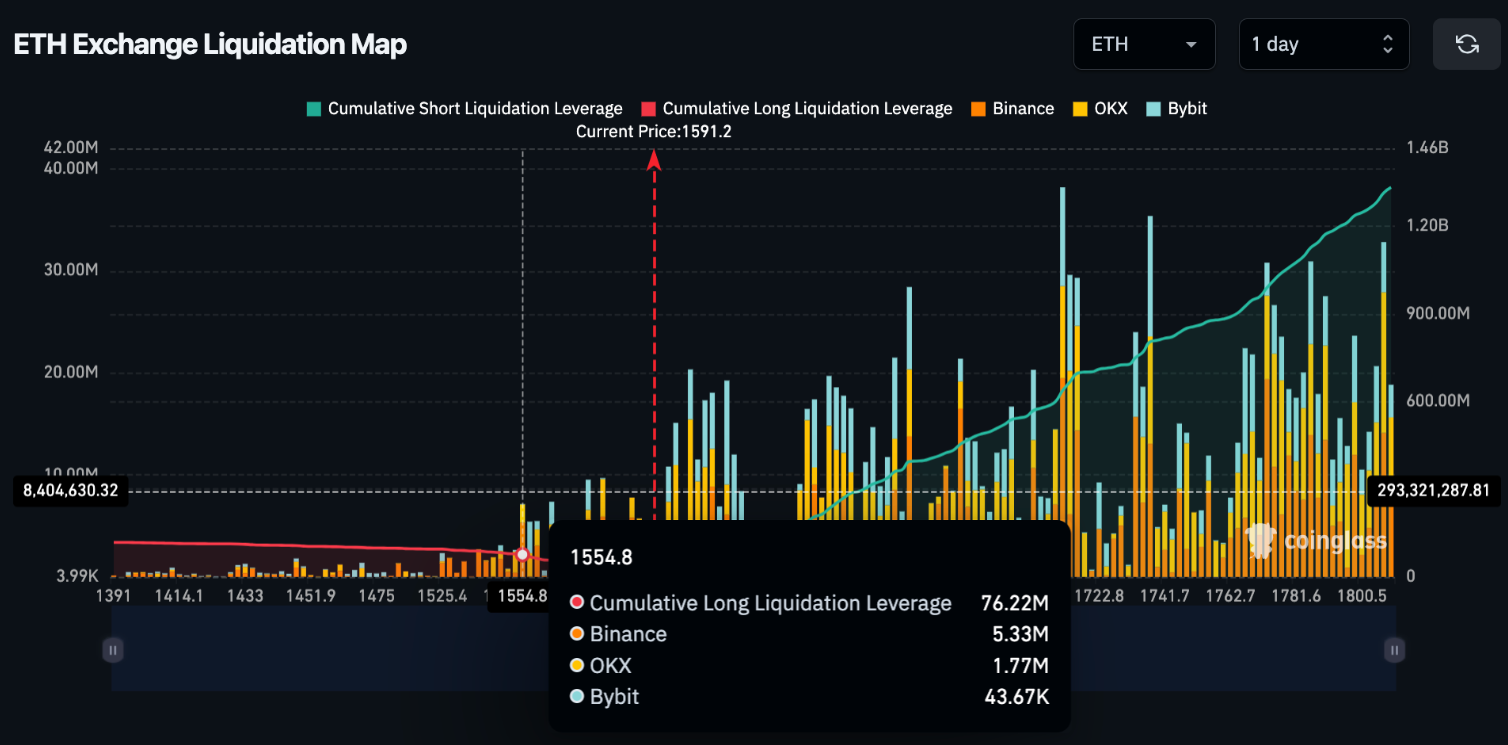

Statistics by Coinglass indicate that Ethereum experienced 164.7 million dollars liquidations in the last day, exceeded only by Bitcoin’s 203.7 million dollars. Out of these, the majority struck traders betting on a price increase, particularly Sunday’s sharp decline.

Ethereum Liquidation Heatmap, Source: Coinglass

The liquidation chart identifies a key support zone between 1550 and 1570 dollars, with 76.2 million dollars worth of leveraged positions concentrated around 1554 dollars.

If Ethereum breaks this level, it may attract buyers looking for lower entry points and help stabilize the price. However, if it falls below, the price could continue to drop toward 1480 dollars or even 1420 dollars, where the support level is less reliable.

Technical Indicators

The price decline has changed Ethereum’s perspective. It is now down below significant technical levels, such as the 1655 dollar VWAP and the 50 day mean of 1787 dollars. The RSI, which measures the marketplace progress, stands at 28.59, indicating that it is in oversold for the very first time since March.

This indicates a potential short run bounce, but the overall direction appears weak. In order for Ethereum to regain progress, it must break up above 1655 dollars and stabilize, which is entirely dependent upon Bitcoin picking up strength above 80000 dollars.

Currently, Ethereum’s next steps rely on that 1554 dollar support point and the performance of Bitcoin. The market is still affected by trade issues and Bitcoin’s fall, making Ethereum open to more losses. Investors are closely watching to see if buyers step in at $1554 or if the price keeps falling into the low $1500s as the new week begins.

Also Read: Bitcoin Breaks Down To $79K Ahead Of Brutal Market Open