Sam Bankman-Fried’s rise to prominence in the cryptocurrency world came crashing down in late 2022. As the founder of FTX, one of the largest cryptocurrency exchanges, that he and his team had mismanaged approximately $8 billion of investors’ funds. Bankman-Fried was convicted of fraud and conspiracy, receiving a staggering 25-year prison sentence. His case has become one of the biggest fraud cases in U.S. history, highlighting the remarkable downfall of someone who was once a leading figure in the world of digital finance.

In the wake of FTX’s collapse, the company announced a proposed settlement focused on meeting its financial responsibilities to creditors and creating a way to pay them back. This settlement is important for restoring some measure of justice and trust in a digital finance landscape.

Key Details of the Proposed Settlement

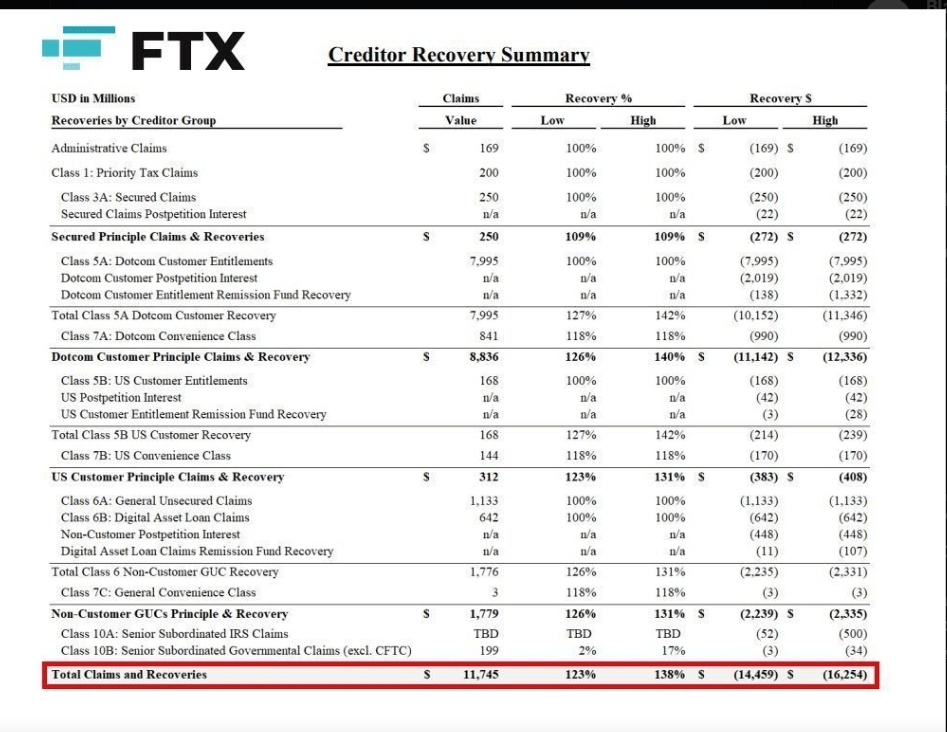

FTX has committed to returning 100% of the assets under its control to creditors as part of its Chapter 11 bankruptcy plan. This promise helps meet the large debts owed to creditors, providing some level of justice after the exchange’s disastrous collapse. By vowing to return all assets, FTX wants to reassure those impacted that their losses will not be overlooked.

The Department of Justice (DOJ) is in charge of distributing assets taken from FTX’s criminal cases. They consider both preferred shareholders and creditors as victims, which complicates how assets are shared. Because of this, the settlement process needs to be managed carefully to be fair to everyone. The DOJ’s involvement is key to making sure things go smoothly and that justice is served.

Both FTX and preferred shareholders are asserting competing claims to the same pool of forfeited assets, adding complexity to the already challenging asset distribution process. The DOJ is tasked with reconciling these claims, and the proposed settlement aims to provide a fair resolution that considers the interests of both creditors and preferred shareholders.

FTX is seeking the DOJ’s agreement to a centralized distribution mechanism through its Chapter 11 plan. This approach is designed to accelerate the distribution of assets to creditors while minimizing substantial and redundant expenses associated with the forfeited assets. By simplifying the distribution process, FTX hopes to ensure that creditors receive their due assets more quickly and efficiently, facilitating a smoother recovery for those affected by the collapse

Maintaining transparency and keeping stakeholders informed is vital for FTX, the FTX Debtors filed a disclosure statement on June 27, 2024, outlining the DOJ forfeiture process and related assets. This approach demonstrates FTX’s commitment to transparency that ongoing challenges of bankruptcy proceedings.

The collapse of FTX in late 2022 made financial losses. Recently, social media has been with rumors that the FTX bankruptcy would begin distributing reimbursement funds to creditors and customers by September 30. However, these claims are misleading, as no reimbursement plan has been approved by the court.

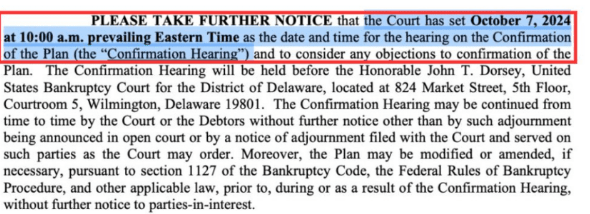

According to an updated Chapter 11 filing, the next court hearing to confirm the restructuring plan is scheduled for October 7. Judge John T. Dorsey of the United States Bankruptcy Court for the District of Delaware will oversee the proceedings. If the court accepts the restructuring plan, claimants with less than $50,000 in claims may receive payouts by the end of 2024, while larger claimants might not see any payouts until the first or second quarter of 2025. This timeline is contingent on the court’s ruling during the October hearing, leaving many creditors in a state of uncertainty.

Conversely, FTX’s legal team maintains that cash payments to creditors are necessary and that any distribution of bitcoin would be illegal under Chapter 11 bankruptcy rules. They assert that deviating from cash payouts could delay the entire bankruptcy process, exacerbating tensions between the legal team and frustrated creditors.

Markus Thielen from 10x Research believes that FTX payouts could inject $5 billion to $8 billion into the market, potentially boosting cryptocurrency prices. Dan Held noted that $16 billion from FTX might soon be available, with creditors likely to reinvest rather than withdraw. Additionally, FTX plans to allocate $230 million from government forfeiture funds to preferred shareholders. As the court date of October 7 approaches, both creditors and market observers are watching closely for impacts on the cryptocurrency market.

Conclusion

As the October 7 approaches, stakeholders in the FTX bankruptcy case are closely monitoring the situation for any updates. The court’s decision will ultimately determine whether creditors will receive funds in cash or crypto and when these payments will be issued, For now, the rumors of imminent payouts remain just that rumors. Until the court approves a final plan, creditors will have to wait for clarity on how and when they can expect to recover their funds.