- The crypto crash by 7.79% in a single day, decreasing the overall worth to $2.46 trillion as a result of economic concerns and fresh international tariffs.

- Almost $1 billion in crypto trades were closed within 24 hours, and larger coins such as Bitcoin, Ethereum, and Solana experienced substantial losses.

- The confidence of the investors is weak, with the Fear and Greed Index set at 17, and everyone is being very cautious because of the uncertainty.

According to CoinMarketCap, the crypto crash had happen badly on April 7, 2025, dropping by 7.79% in just one day, with the total market value coming down to $2.46 trillion. This happened as global economic concerns grew.

The major reason for crypto crash could be, Interest rates are still rising, and recent global tariffs announced by former U.S. President Donald Trump put the pressure on.

These developments impacted the stock market as well, and because crypto tends to mirror the same thing, it was hit hard too. With so much uncertainty surrounding it, investors are holding back and waiting to see what happens.

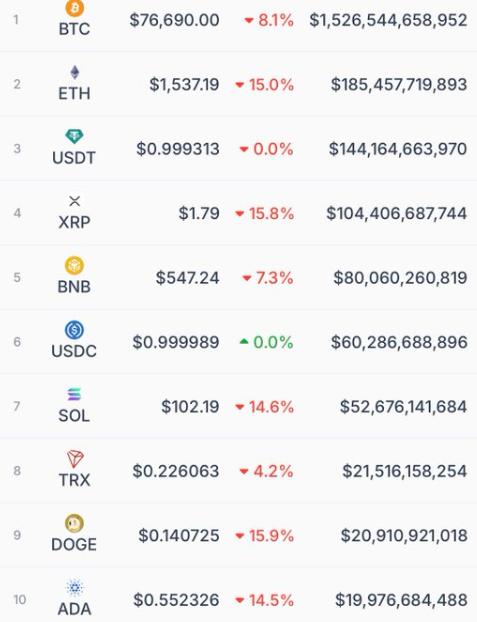

Top Digital Assets Decline

In the last 24 hours alone, almost $985.78 million worth of crypto transactions got liquidated because of crypto crash. That is nearly a billion dollars lost in a very short time.

Major coins like Bitcoin and Ethereum were hit badly. Bitcoin fell to $76,690.00, down 8.1%, and Ethereum went even lower down 15.0% to $1,537.19. XRP was down 15.8% and currently stands at $1.79. Binance Coin was down 7.3%, and Solana fell by 14.6%. No major cryptocurrency was spared as everything was going down.

Market Sentiment Turns Weak

The Fear and Greed Index is now at 17, which shows a very low level of confidence in the market.

Source: Coin Market Cap

Others view this as an opportunity to purchase at lower rates, but the majority of investors are holding back. The recent decline in US stocks following Trump’s new tariffs has contributed to the fears. For the time being, many are keeping away from uncertain assets such as crypto.