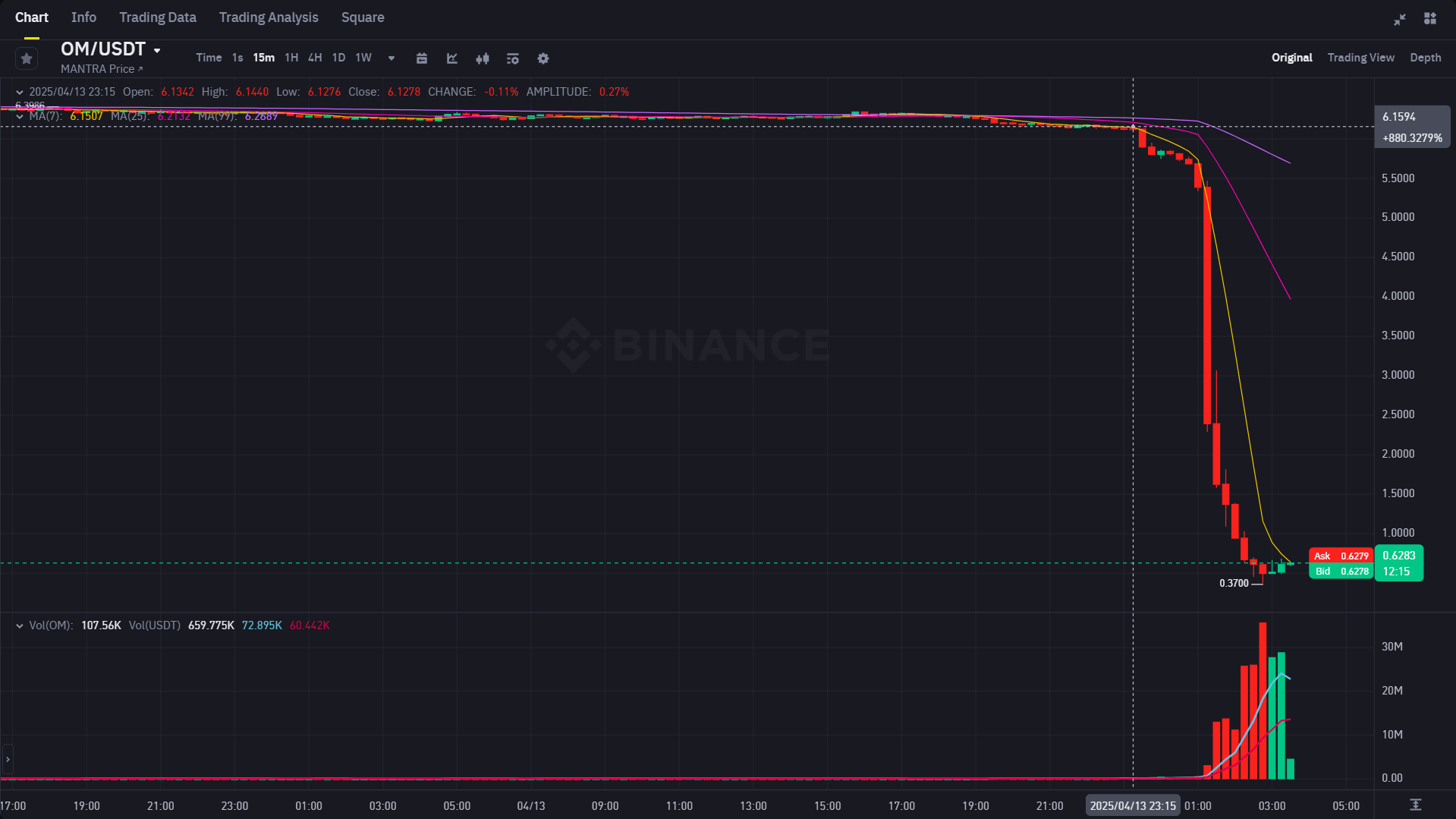

The price of the Mantra token $OM, dropped by over 90% in 24 hours on April 13.

The collapse, which saw OM drop from an all-time high of $6 to a low of $0.37, with speculation of a potential “rug pull” and concerns of market manipulation.

Even as the actual reason behind the crash is still unclear, most are attributing it to the possibility of the Mantra team offloading their stake, which fueled the huge sell-off.

The team was accused of having nearly 90% of the Mantra token supply in their control, which raised suspicions among investors and led to the sharp price fall. The Mantra team, however, which is headed by co-founder John Patrick Mullin, has dismissed the accusations.

MANTRA Token Co- Founder response:

In a statement, Mullin clarified that the crash was caused by forced liquidations on a centralized exchange. He explained that the team did not sell any tokens and that all OM tokens were locked following the project’s vesting schedule. Mullin added that the liquidations were triggered during hours of low liquidity, amplifying the market’s response.

In spite of the shocking crash, Mantra has reaffirmed its long-term dedication to the project. The team is addressing concerns and offering more clarity to the community.

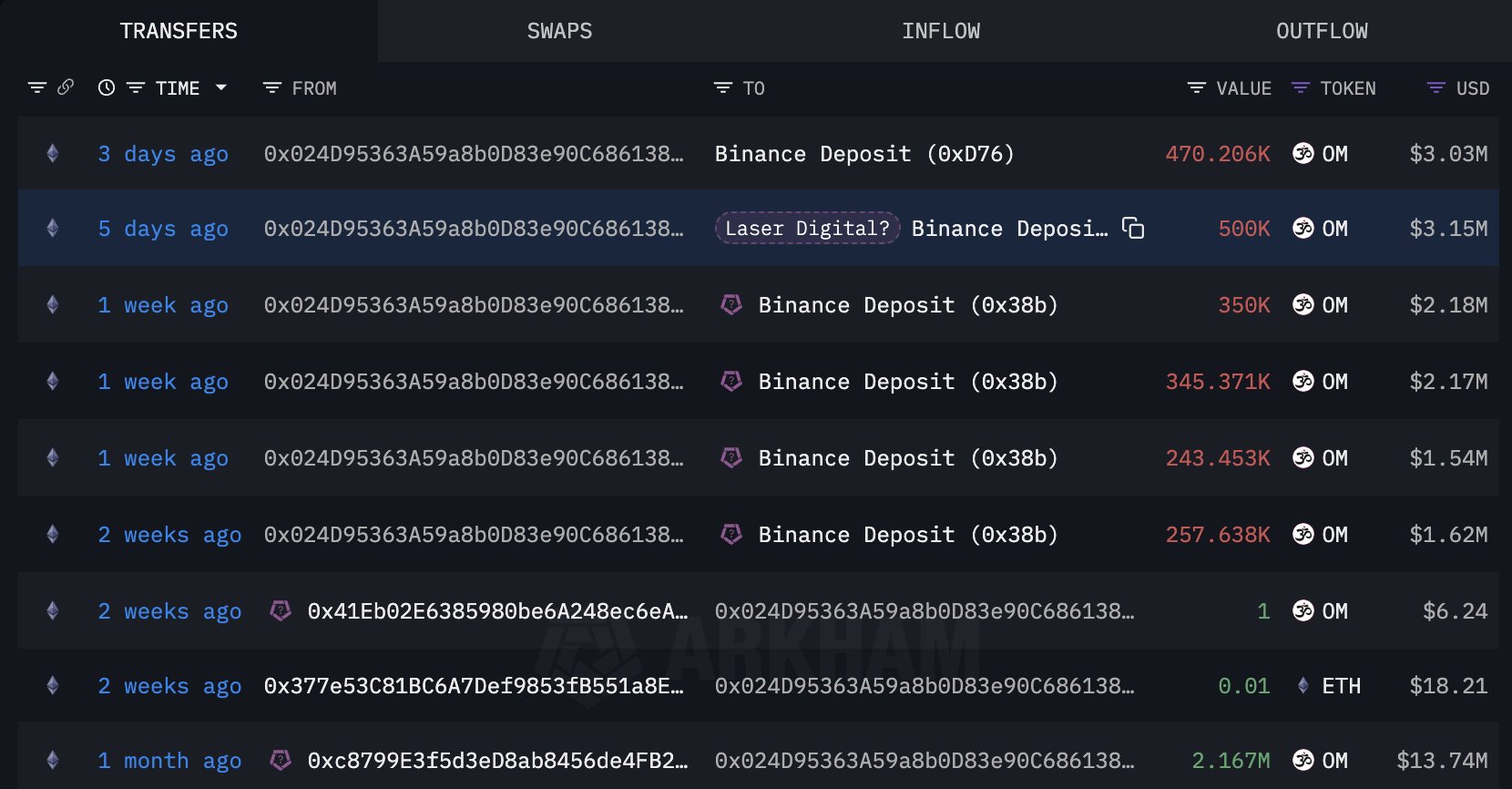

It is believed that, Laser Digital could be behind the sharp drop of $OM. Their 17 wallets transferred over $40M into centralized exchanges just 2 days before the crash.

Laser Digital is a major investor in $OM, with $108M invested in the MEF program. The liquidation might have been triggered by recent market fluctuations, potentially leading to losses. Keep an eye on other assets they’re investing in, as their actions could influence the market.

Also Read: Crypto Regulations: US SEC Explores New Regulatory Strategy