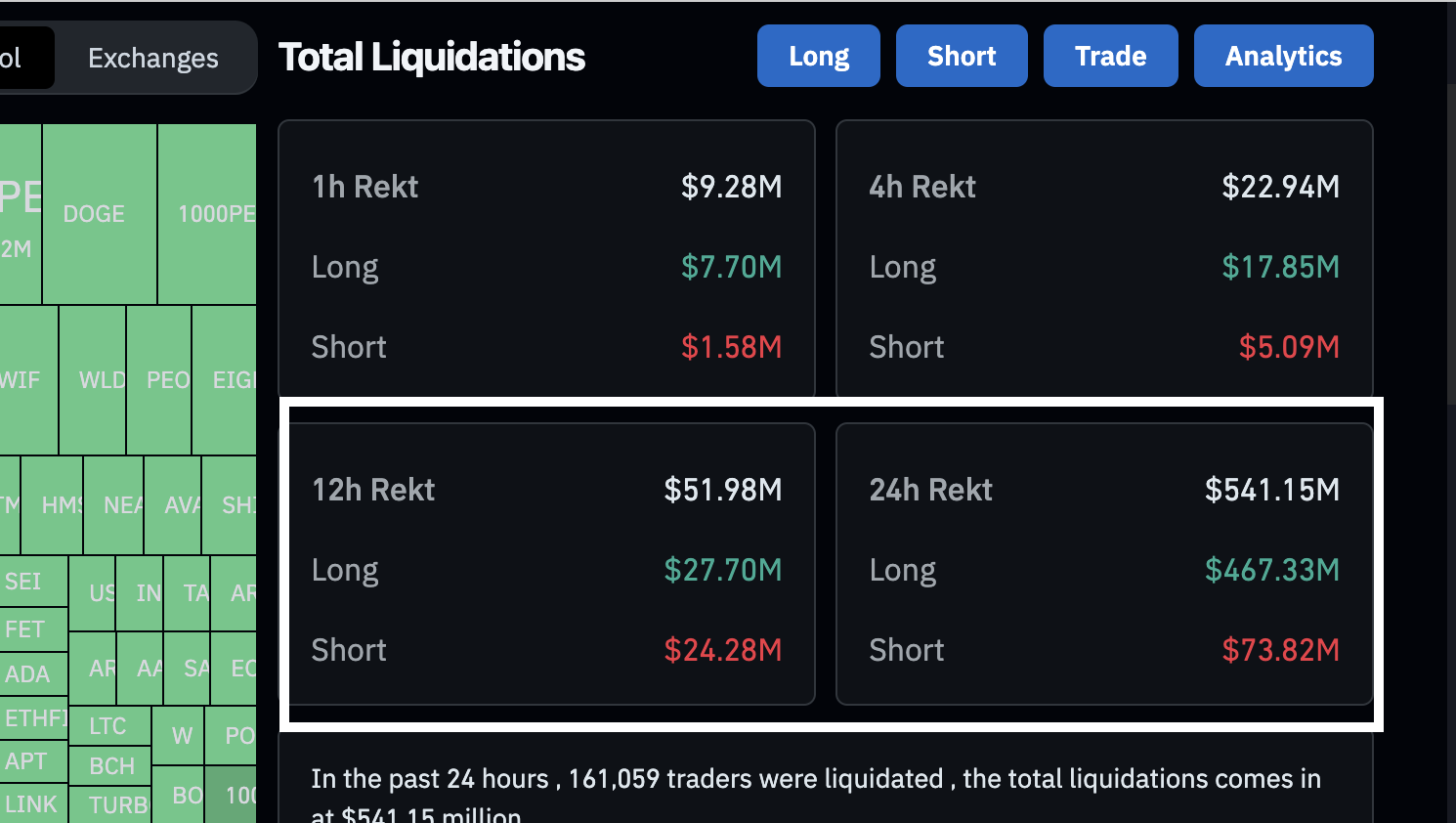

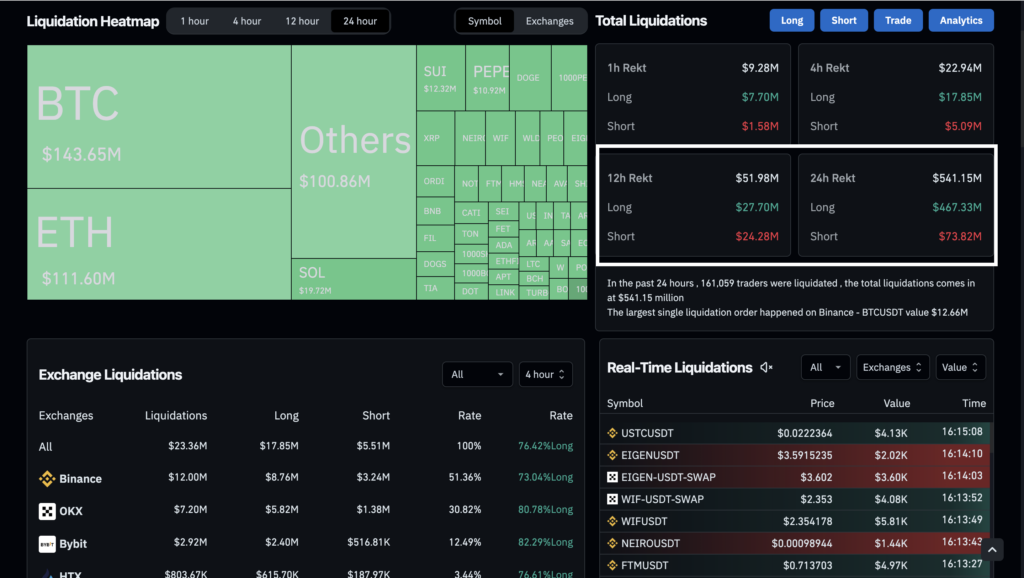

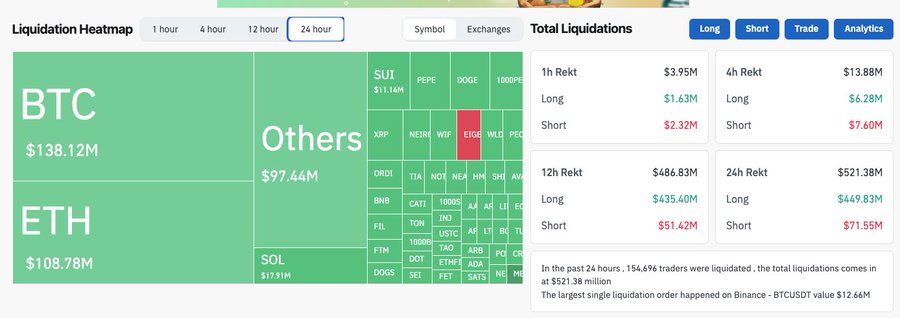

The last 24 hours were particularly busy for cryptocurrencies. About ~$523.38 million worth of contracts were liquidated due to Bitcoin crash, with around ~$451.95 million coming from long positions and ~$71.44 million from shorts. This large activity shows the risks and volatility traders face, especially during major liquidations.

Understanding Crypto Liquidation

Liquidation is the process where a trader’s positions are forcibly closed by an exchange. This occurs when a trader’s margin account cannot support their open positions due to losses. When the account balance falls below the required margin level, the exchange steps in to close the positions to cover any losses and outstanding debts.

For traders, Bitcoin crash causes liquidation which leads to financial losses. Therefore, it’s crucial to manage risk effectively, monitor margin levels, and employ strategies to avoid such situations.

Bitcoin Crash & It’s Impact :

In the last 24 hours, we witnessed liquidations totalling around $500 to $540 million, with approximately 83% of these being long positions. This marks the second-highest liquidation level since the capitulation on August 5th. Overall, there was a massive $1 billion in liquidations, almost entirely attributed to long positions.

Here’s a breakdown of the liquidations by cryptocurrency:

- Bitcoin (BTC): $541 million

- Ethereum (ETH): $307 million

- XRP: $24 million

- Litecoin (LTC): $12.48 million

- Dogecoin (DOGE): $12.48 million

In last 24 hours, the total long liquidation was about $500 million. This includes:

- Bitcoin long liquidation: $123 million

- Ethereum long liquidation: $96 million

- Altcoins long liquidation: $281 million

Notable Liquidation Events

The recent liquidations in Bitcoin are more significant compared to previous days. Here are some notable dates when large liquidations occurred:

- August 5, 2024

- July 4, 2024

- May 19, 2024

- May 5, 2024

- January 3, 2024

- November 14, 2023

- August 17, 2023

Interestingly, August 17, 2023, recorded the highest liquidation since the market’s bottom in December 2022. This shows that the market is still prone to extreme fluctuations, affecting traders’ strategies and financial well-being.

What Does “Rekt” Mean in Crypto?

It signifies the situation where traders suffer major losses or feel financially “wrecked.” Derived from the word “wrecked,” it reflects the emotional toll of poor trading decisions or unfortunate market movements.

When someone mentions getting “Rekt,” it typically means they experienced substantial losses in their investments. While often used humorously, it highlights the risks involved in trading cryptocurrencies, especially in such volatile conditions.

Conclusion

The recent liquidations in the cryptocurrency market, particularly the ~$541 million worth of contracts, underscore the importance of understanding margin trading and the risks it carries. As many traders faced liquidation, it serves as a reminder of the market’s unpredictability.