MicroStrategy $42 billion plan over the next three years, which will be used for purchasing more Bitcoin.

MicroStrategy, a well known business intelligence firm, has revealed a plan to spend $10 billion on Bitcoin next year. This amount is greater than what the company has spent on acquiring Bitcoin since 2020. MicroStrategy’s strategy to build its Bitcoin holdings has been a major part of its operations. MicroStrategy $42 billion plan over the next three years, which will be used for purchasing more Bitcoin.

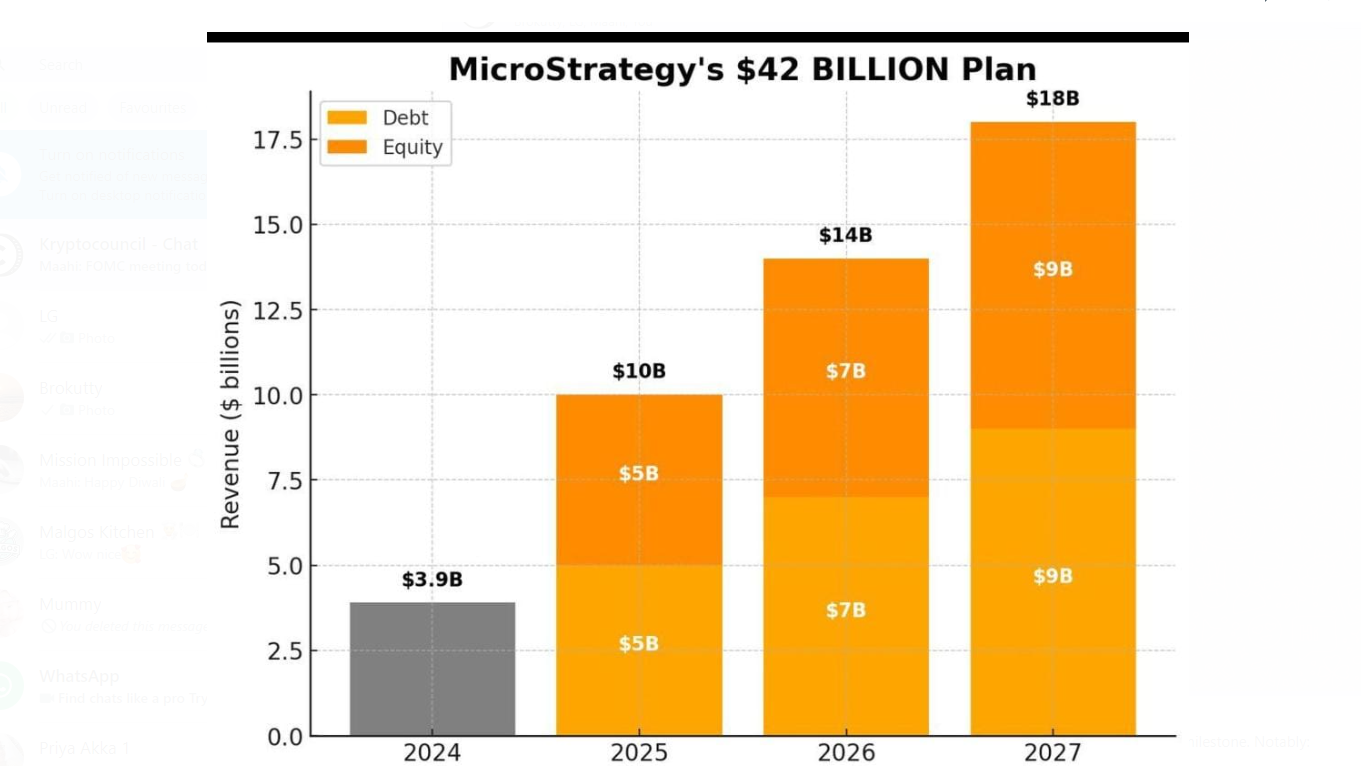

MicroStrategy’s $42 Billion Plan

MicroStrategy $42 Billion plan, named the “21/21 Plan,” involves raising $42 billion in capital, split into two parts: $21 billion from equity and $21 billion from fixed income securities. The company will use this capital to increase its Bitcoin holdings majorly. This plan will span the next three years, and its main goal is to increase the company’s Bitcoin reserves as a treasury asset.

By executing this plan, MicroStrategy intends to further enhance its Bitcoin yield. Phong Le, the company’s president and CEO, stated that

“The goal is to achieve higher Bitcoin returns by using the additional capital to buy more Bitcoin. As of now, the company holds a significant amount of Bitcoin and plans to continue accumulating more.“

A Big Investment in Bitcoin

MicroStrategy’s latest move comes after the company reported a year to date Bitcoin yield of 17.8%. This yield is an important metric for the company, as it measures the returns from its Bitcoin holdings. The firm aims to achieve an annual BTC yield between 6% and 10% from 2025 to 2027.

The company’s latest purchases have further increased its Bitcoin reserves. In mid September, MicroStrategy acquired 7,420 bitcoins for $458.2 million. This brought its total Bitcoin holdings to around 252,220 bitcoins, worth over $18 billion at the current price of around $72,000 per Bitcoin.

MicroStrategy’s Recent Capital Raise

Earlier this year, MicroStrategy raised $2.1 billion through both equity and debt providings, using a portion of that capital to acquire more Bitcoin. The company also completed a $1.01 billion providing of convertible senior notes in September, with plans to use some of the proceeds to purchase more Bitcoin.

(adsbygoogle = window.adsbygoogle || []).push({});MicroStrategy’s overall goal is to continue growing its Bitcoin reserves. With the MicroStrategy $42 billion plan in place, the company is looking to strengthen its position in the cryptocurrency space. It sees Bitcoin not just as a digital asset but as a key part of its business strategy.

MicroStrategy $42 billion plan is to raise and continue acquiring Bitcoin could have an impact on both the company and the market. Bitcoin users and analysts have pointed out that the size of this plan is enormous. For context, $21 billion is roughly the total market capitalization of all public Bitcoin miners combined.

Financial Results and Bitcoin Yield

MicroStrategy’s most recent financial results show that the company continues to generate strong returns from its Bitcoin strategy. The firm’s Bitcoin yield for the third quarter was 17.8%, a measure it uses to track how well its Bitcoin holdings are performing. The company’s quarterly sales, however, missed analysts’ expectations, and its operating expenses increased due to digital asset impairment losses.

Despite these challenges, MicroStrategy’s focus on Bitcoin remains clear. The company has set an ambitious target for its Bitcoin yield in the coming years. With its “21/21 Plan,” MicroStrategy aims to further increase its Bitcoin holdings and its yield from these assets.

What’s Next for MicroStrategy?

MicroStrategy is committed to its Bitcoin strategy. The company is set to raise more funds through equity and debt offerings, with the goal of continuing to buy Bitcoin. This strategy is seen as a way to drive shareholder value by holding more Bitcoin as a reserve asset.

The company’s stock has shown impressive growth this year, up over 250% year-to-date, despite some fluctuations in after-hours trading. Investors will be watching closely to see how the “21/21 Plan” unfolds and how it will affect both the firm’s stock and its Bitcoin reserves.

(adsbygoogle = window.adsbygoogle || []).push({});Source : Yahoo Finance.

Conclusion

MicroStrategy’s decision to spend $10 billion on Bitcoin next year shows its ongoing commitment to Bitcoin as an important part of its business strategy. MicroStrategy $42 billion plan to raise capital over the next three years will help the company continue to grow its Bitcoin holdings, further solidifying its position as the largest corporate holder of Bitcoin.

As the company’s plans move forward, the attention of both the crypto world and financial analysts will be on MicroStrategy to see how its strategy unfolds and how it continues to leverage Bitcoin for future growth.

(adsbygoogle = window.adsbygoogle || []).push({});