Between October 31 and November 10, 2024, MicroStrategy bought about 27,200 bitcoins, spending roughly $2.03 billion in cash at an average price of $74,463 per bitcoin. This brings their total holdings to around 279,420 bitcoins, purchased for an average price of $42,692 each.

How They Paid for Bitcoin

To fund these purchases, MicroStrategy sold some of its own stock. Initially, in August, it had an agreement to sell shares worth up to $2 billion. Recently, it added another agreement in October to sell shares worth up to $21 billion. As of November 10, it has already raised about $2.03 billion through these stock sales, allowing the company to keep buying Bitcoin.

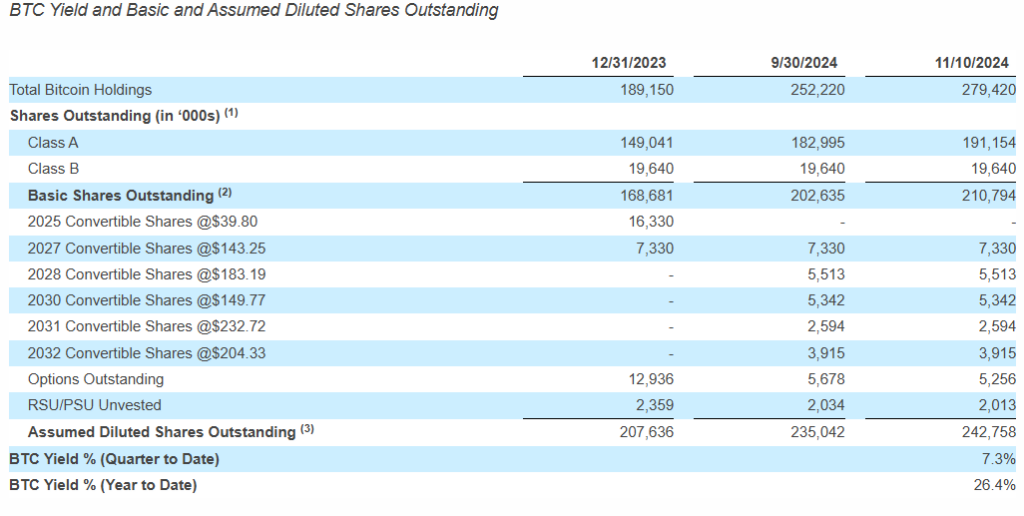

Tracking BTC Yield

MicroStrategy uses a special measure called “BTC Yield” to assess its Bitcoin strategy. BTC Yield shows how much their Bitcoin holdings have grown relative to the number of shares they have. For example, between October and November 2024, their BTC Yield increased by 7.3%, and for the whole year so far, it’s up by 26.4%. This measure helps the company check if buying Bitcoin with funds raised by issuing stock is benefiting its shareholders.

MicroStrategy’s Goal

MicroStrategy’s strategy is to hold Bitcoin long term, using stock and debt sales to keep buying. They aim to offer investors exposure to Bitcoin’s potential while also providing software analytics services through their other business.

- Total Bitcoin Holdings (as of Nov 10): 279,420

- Total Spent on Bitcoin: $11.9 billion

- Average Cost per Bitcoin: $42,692

- BTC Yield (Oct – Nov): 7.3%

- BTC Yield (2024 YTD): 26.4%

As MicroStrategy implementing its $42 billion plan of spending in $10 billion bitcoin by 2025.