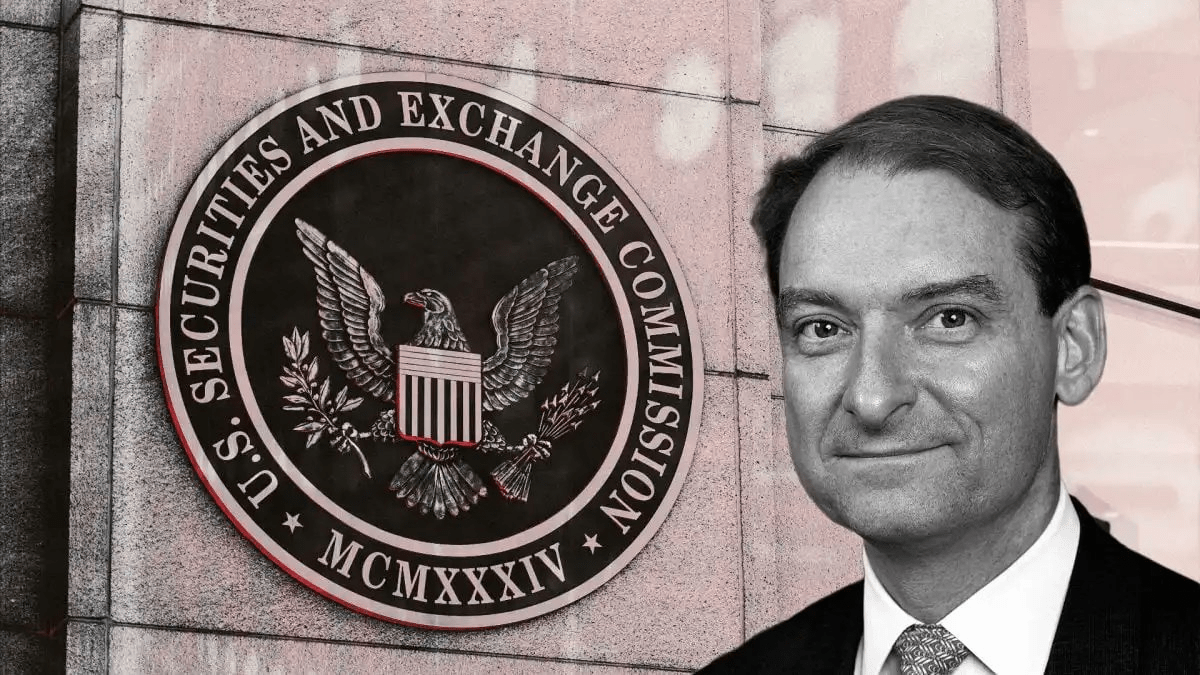

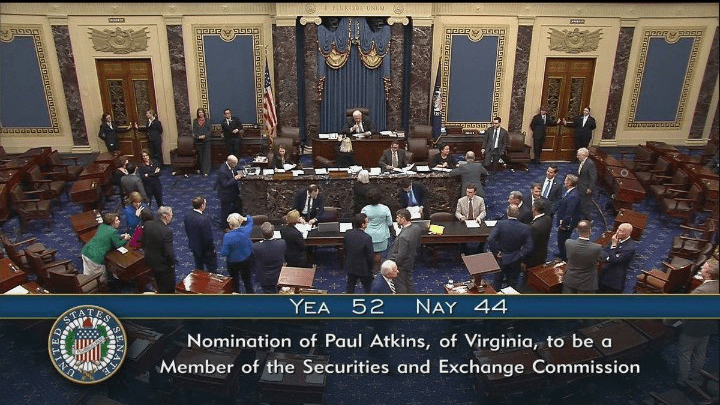

- The U.S. Senate on Wednesday confirmed Paul Atkins as the SEC’s new chairman, putting the crypto friendly leader in a position to reshape financial regulation.

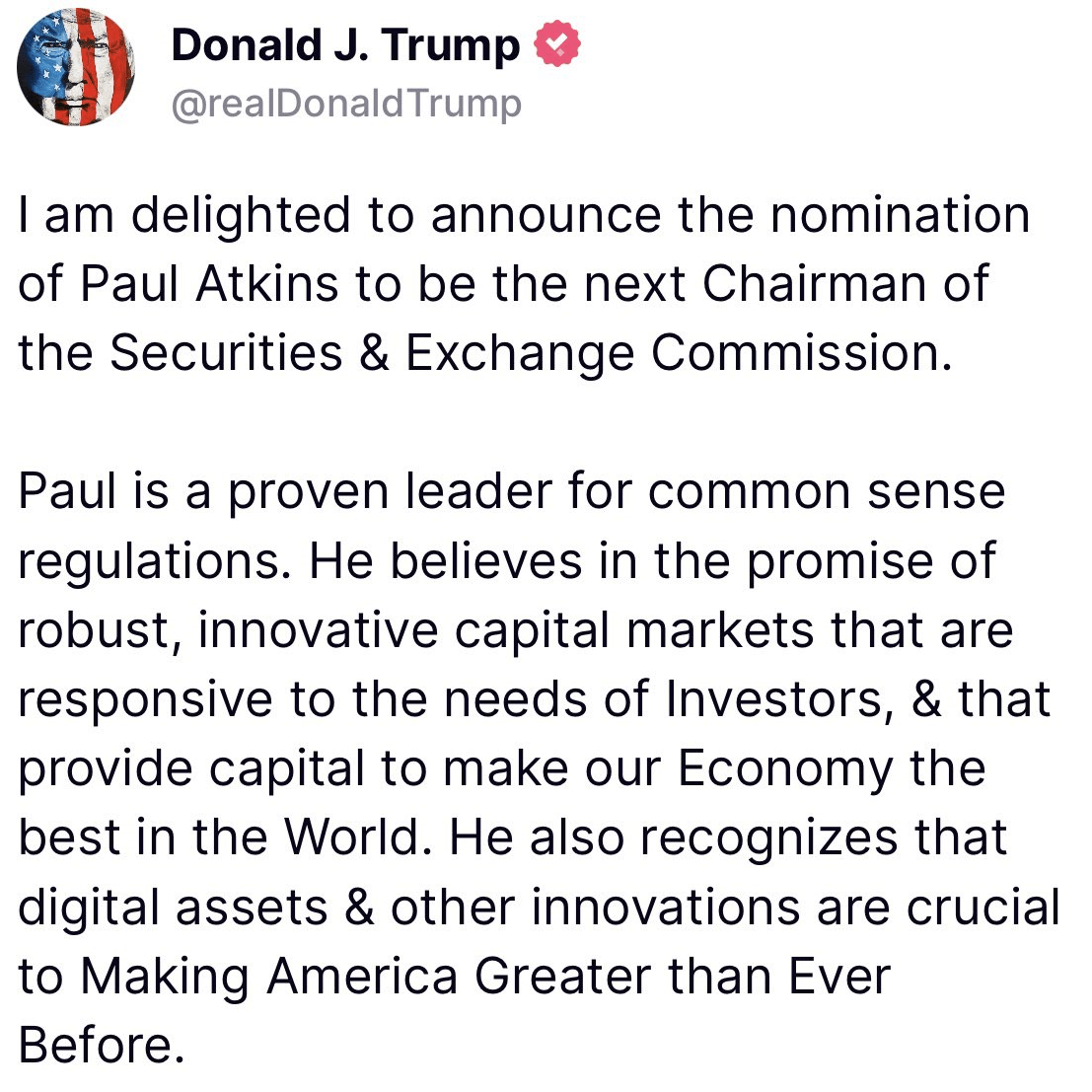

- President Donald Trump nominated Atkins, who replaces Gary Gensler, whose leadership collided with digital asset firms.

- The confirmation generates expectations of simpler crypto rules and a pro innovation approach, although critics signal less investor protection.

Paul Atkins New Path

Paul Atkins is an SEC commissioner who brings decades of regulatory experience, having worked as commissioner during President George W. Bush’s administration. After leaving the SEC, he established a consulting company that advised crypto startups and co chaired the Token Alliance, promoting blockchain innovation.

Financial disclosures indicate Atkins maintained up to $6 million in digital assets, including interests in Anchorage Digital and Securitise. He’s now selling those stakes to preclude conflicts, an action highlighted at his confirmation.

“Time to bring common sense back to the SEC,” Paul Atkins announced at his March 27 hearing, deriding predecessors as engaging in “vague, aggressive policies.” His career intersects Wall Street regulation and crypto lobbying, making him a bridge between regulators and innovators.

Digital Assets, New Directions

Atkins promises to prioritize rule clarity over enforcement, deviating from Gensler’s lawsuit driven approach. During Gensler’s tenure, the SEC went after companies such as Coinbase and Ripple, triggering industry pushback. Acting chair Mark Uyeda recently put the brakes on litigation, suggesting this change.

Atkins intends to speed up approvals of crypto ETFs and streamline token classification, which could be a boon for altcoins such as Solana and Dogecoin. “Clarity drives growth,” he stated, indicating receptiveness to blockchain based financial products. In addition, industry associations welcome his emphasis on capital formation and market efficiency.

Crypto leaders hail Atkins confirmation as a regulatory turning point. “This ends the guessing game,” said a Coinbase executive, anticipating streamlined compliance. Analysts are predicting faster adoption of stablecoins and decentralised finance platforms.

How This Will Impact U.S Financial Market

Atkins confirmation marks a regulatory shift, fitting Trump’s bid for U.S. crypto hegemony. While opponents worry about loose regulation, supporters believe clarity will draw foreign investment. As Atkins awaits his swearing in, the financial world waits with bated breath: Will his vision create innovation or relive history? The answer may redefine America’s economic future.

Also Read : Paul Atkins To Lead SEC, Greenlights US Senate Banking Committee