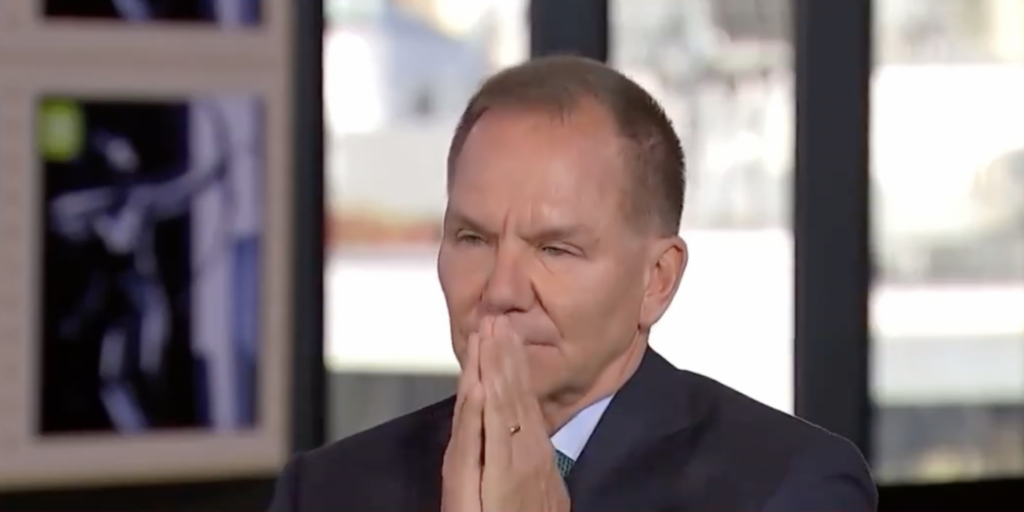

Billionaire investor Paul Tudor Jones has shared his views on how to manage investments during uncertain times. In a recent interview with CNBC, Paul Tudor Jones explained why he is holding onto gold, Bitcoin, and commodities to protect against inflation.

He believes that neither of the U.S. Presidential Candidates have a strong plan to tackle the country’s growing debt, making it crucial to take action now.

Why Paul Tudor Jones is Concerned About U.S. Debt

Paul Tudor Jones, a well-known hedge fund manager, is concerned about the future of the U.S. economy. According to him, the government’s rising debt is a serious issue that needs immediate attention. Both political candidates, however, have made promises of tax cuts and increased spending, which could make the debt problem even worse.

Jones pointed out that if the debt issue is not handled properly, the U.S. may face a situation where the only solution is to inflate its way out of debt. This means that the government would likely print more money, causing inflation to rise. As a result, the value of money could decrease, which is why Jones is looking for ways to protect his wealth.

Gold and Bitcoin as Safe Investments

Paul Tudor Jones explained that he has chosen to invest in gold and Bitcoin because they can act as a hedge, or protection, against inflation. He mentioned that he is “long” on gold, which means he believes the price of gold will go up. Gold has always been seen as a safe investment during times of economic uncertainty because it holds its value.

Bitcoin, often referred to as “digital gold,” is also becoming a popular choice for people looking to safeguard their money. Jones has been a supporter of Bitcoin for some time now, and he sees it as a valuable asset that can help protect against the effects of inflation.

Why Commodities Are Also Important

In addition to gold and Bitcoin, Jones believes that commodities, like oil, gas, and agricultural products, are “under owned” and could offer good returns. Commodities are basic goods that are used in everyday life, and their prices often rise when inflation is high. For Jones, investing in these essential products is a smart way to avoid losing money when inflation strikes.

He noted that most young people prefer to invest in the Nasdaq, a stock market index that focuses on technology companies. While Jones agrees that tech stocks have done well in recent years, he prefers to balance his portfolio with commodities and other inflation-proof assets.

Inflation Risk After the Election

Paul Tudor Jones is particularly worried about what might happen after the U.S. presidential election. Both candidates, that is Trump vs Harris have promised policies that would increase the national debt, which could lead to more inflation. If the government continues to spend without addressing the deficit, inflation is likely to become a bigger issue.

Jones stated that the country will need to find ways to grow the economy while keeping inflation in check. Otherwise, the U.S. could face a situation where its debt becomes unmanageable, and bond investors who lend money to the government might lose confidence. This could cause bond prices to drop, leading to higher interest rates and a shaky financial future.

For investors, Paul Tudor Jones’ strategy offers a lesson in how to prepare for potential economic trouble. Holding assets like gold, Bitcoin, and commodities can provide a buffer against inflation, especially when the future of the economy is uncertain. While stocks, like those in the Nasdaq, can offer growth, Jones is focused on safeguarding his wealth by investing in assets that are likely to perform well during times of inflation.

Conclusion

Paul Tudor Jones is positioning his portfolio to protect against inflation and rising debt. By investing in gold, Bitcoin, and commodities, he believes he is better prepared for what could be a challenging economic future. His advice to other investors is clear, stay informed, and consider adding inflation proof assets to your investment strategy.