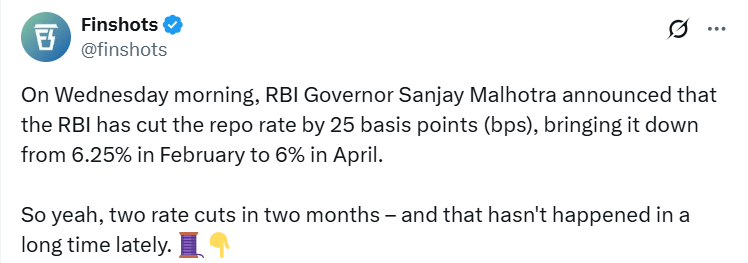

- RBI reduced the repo rate by 25 basis points to 6% to cut borrowing costs of banks and borrowers.

- Most banks have not fully passed on the February rate cut due to high funding costs and rising bad loans, delaying the benefits for borrowers.

- Residential real estate prices across leading cities increased 17% over the past year, leaving the impact of the rate reduction essential for homeowners.

RBI rate cut of 25 basis points to 6% was announced on Wednesday after a three day Monetary Policy Committee meeting chaired by Governor Sanjay Malhotra, which began on April 7.

RBI rate cut refers to a reduction in the repo rate, which is the rate at which the Reserve Bank of India lends money to commercial banks. It will lower banks’ cost of borrowing, which should be passed on to customers through lower loans, like home loans. This is the second consecutive rate reduction after one in February.

RBI Rate Cut and Borrower Hopes

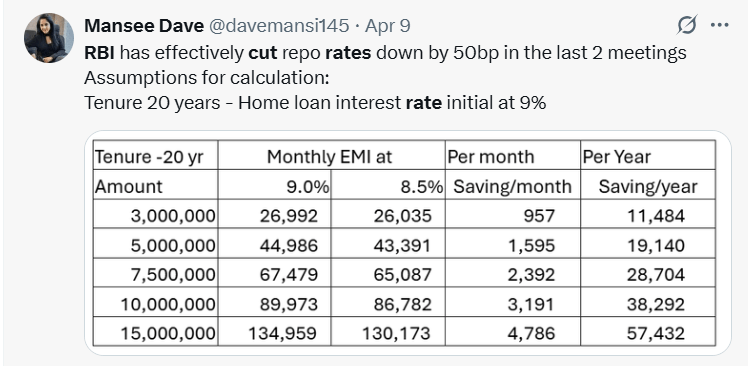

The RBI rate cut should benefit borrowers, as majority of home loans are now repo rate linked. New borrowers may get lower rates soon if the banks act in a timely manner.

For current borrowers, the relief varies with their loan’s reset interval, which can be every three or six months. Yet banks have not done so entirely pass through the rate cut in February.

Experts say banks are slow to pass on the rate cuts because of higher funding costs, rising bad loans, lower profits, and careful lending. So, it might take more time for borrowers to feel any relief.

Housing Market Trends

Home prices have gone up by a considerable amount, rendering the rate cut’s impact critical. ANAROCK Research reveals that the average price of homes in the seven prime cities has increased 17% over the last year, from Rs 7,550 per square foot during Q1 2024 to Rs 8,835 per square foot during Q1 2025.

NCR witnessed a price rise of 34%, while Bengaluru registered a 20% increase. ANAROCK Group’s chairman Anuj Puri noted that banks’ slow response in passing on the recent rate cuts could limit support for homebuyers, especially those looking for more affordable housing.

Puri advocated for borrowers failing to receive affordable rates to talk terms with the current bank or shift lenders in a bid for favorable terms. He also said to utilize the saved money due to lower EMIs in reducing the loan duration or investing in some form or spending it on consumption.

Chartered Accountant Dr. Suresh Surana, founder of RSM India, pointed out that following the RBI rate cut, loans linked to the repo rate are expected to see a 25 basis point reduction in interest rates. However, loans tied to older benchmarks like MCLR may not adjust as swiftly, so the benefit depends on the loan type and how the bank responds.

Also Read: US Inflation Downfall Continues with New CPI Release