- SEC revises and adapts former crypto rules following President Trump’s executive order in 2025.

- Prior primary documents such as a guide prepared in 2019 and those reports in the period of 2020-2022 are being reassessed to suit today’s crypto economy.

- Stablecoins USDT and USDC are not treated as securities, but they should adhere to clean financial regulations.

The U.S. Securities and Exchange Commission is implementing some changes to its approach to handling cryptocurrency regulations.

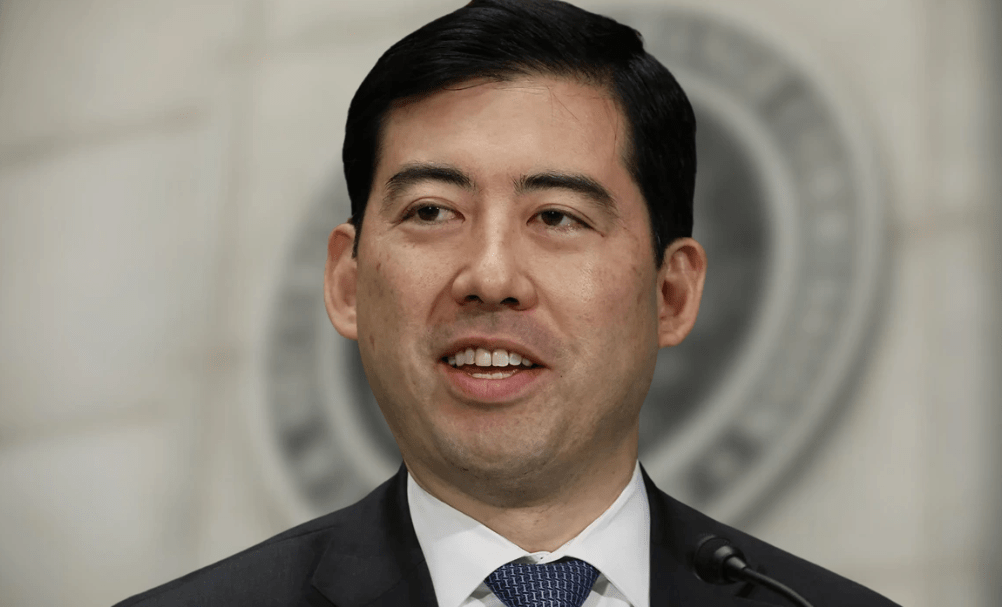

Acting Chair Mark Uyeda requested his staff revisit a number of current guidelines. This initiative came after Executive Order 14192, signed in January 2025 by President Trump, which aimed to lower antiquated rules to aid business.

Uyeda hopes to refresh or repeal rules that don’t align with the its current priorities, particularly as the cryptocurrency market grows.

Revisiting Key Guidance from the Past

One of the central components of this review is a 2019 paper that assists in deciding whether digital assets, such as tokens, are securities. It follows up on a 2018 speech by Bill Hinman, its former staffer, who stated that a token’s status based on how much a central group controls it. That opinion raised some controversy, and now Uyeda’s team is revisiting.

They are also reviewing other documents, including a 2022 report on how to handle cryptocurrency company concerns, a 2021 notice regarding investment risks, and a 2020 note regarding banks owning digital assets.

This would reverse some of the more draconian rules put in place by previous Chair Gary Gensler, who was well known for having a strong position on cryptocurrency that some saw as holding things up.

The review does not end there. Uyeda has instructed staff to review rules on disclosures of cryptocurrency, custody, and Bitcoin futures.

On April 4, 2025, the SEC explained that stablecoins such as USDT and USDC, which are dollar denominated and reserve backed, are not securities. This ruling is in favor of those coins, although algorithmic stablecoins are not treated equally.

The security exchange indicated that the issuers of stablecoins cannot provide profits or combine reserve funds with cash used for business operations, evidencing a level headed approach in Trump’s presidency.

Clearer Rules Around Stablecoins and Custody

The process implies a change in how the SEC approaches cryptocurrency. With Uyeda leading the agency, and guidance from names such as Hester Peirce and Paul Atkins, the security excange is more interactive with the sector. They have met and discussed with firms such as BlackRock regarding cryptocurrency ETFs. The aim is to remove outdated rules and build a system that supports growth without ignoring investors’ safety.

Also Read: Stablecoin Regulations: Kirsten Gillibrand’s Push Gains Momentum