- Teucrium’s new ETF doubles XRP’s daily price changes, launching April 8 on NYSE Arca.

- It tracks XRP using European products, charges 1.89%, and a short ETF is planned.

- Ripple’s SEC settlement raises hopes for a spot XRP ETF in 2025.

Teucrium Investment Advisors is introducing the first leveraged XRP exchange traded fund in the US, after winning approval from the Securities and Exchange Commission.

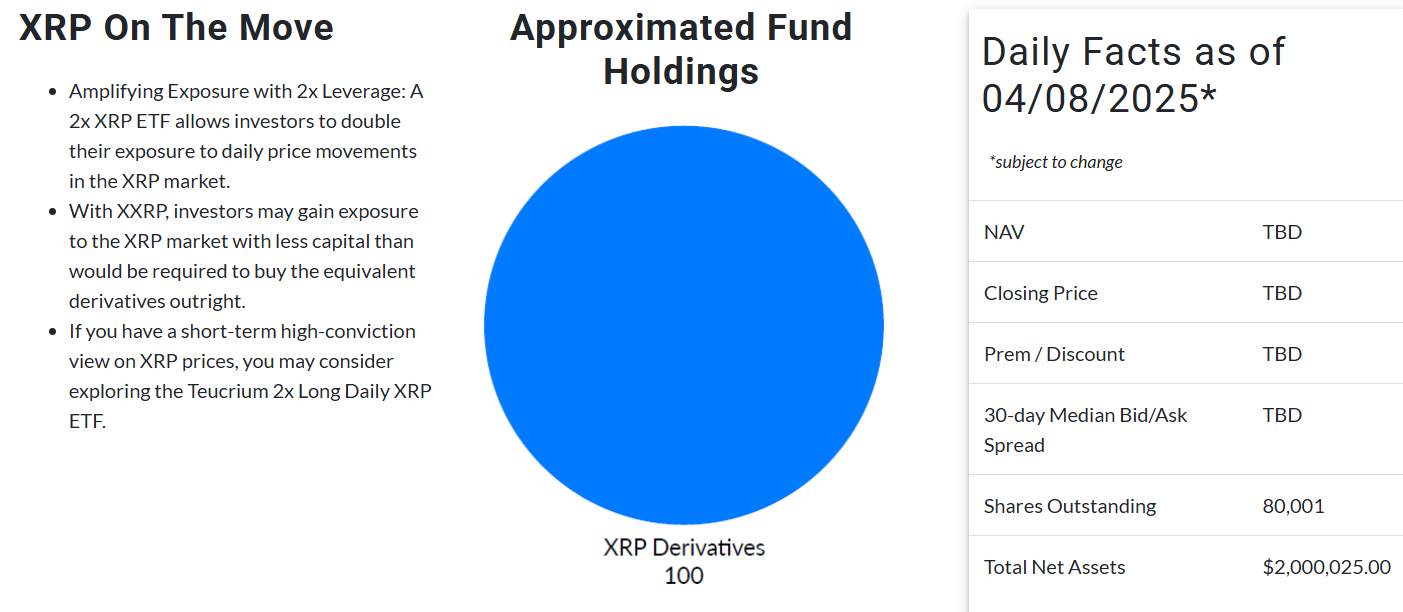

The fund, the Teucrium 2x Long Daily XRP ETF, will begin trading on April 8 on the NYSE Arca under the symbol XXRP as reported by Bloomberg. It seeks to provide twice the daily price action of XRP, so if XRP increases by 1%, the ETF is looking for a 2% increase, but losses would also be doubled.

The fund has a management fee of 1.89% as per the company’s prospectus and is suitable for short-term traders who have strong opinions on XRP’s daily price fluctuations.

Tracking XRP and Future Plans

To monitor the performance of XRP, Teucrium will draw on benchmarks such as the CME CF XRP Dollar Reference Rate and European XRP exchange traded products, since there are no U.S. spot XRP ETFs yet.

The introduction comes on the heels of a recent settlement between XRP’s developer, Ripple Labs, and the SEC, which ended an ongoing court battle with a $50 million fine. With this, the clearness has increased investment product interest in XRP.

Details of Teucrium’s soon-to-be-launched XXRP ETF. Source: Teucrium

Teucrium, with $311 million in assets under management and earlier brought out a Bitcoin futures ETF in 2022, also is gearing up for a 2x Short Daily XRP ETF to enable investors to profit from declines in price.

Market Context and Analyst Insights

Bloomberg ETF analyst Eric Balchunas said it’s rare for the first ETF of an asset to be a leveraged product instead of a spot fund.

He continued that the prospects of a spot XRP ETF approval being imminent continue to be high, as there are multiple applications from companies such as Bitwise, Grayscale, and Franklin Templeton with the SEC.

Teucrium CEO Sal Gilbertie said the timing is ripe for the rollout, pointing to high investor demand and cheaper XRP prices as a window of opportunity. The fund begins trading with $2 million in net assets. Though this ETF is a milestone for XRP in mainstream markets, it’s constructed for active traders because it is leveraged and has a daily orientation.

Also Read: Are Bitcoin ETF Inflows Drying Up? What’s Next for the Market?