- Gold rate today exceeded $3,130 and silver reached $31.26 on anticipated Fed rate cuts and a declining Chinese yuan.

- A pause in U.S. tariffs lifted stocks, but worries about a slowing economy kept demand strong for silver and gold.

- Four cuts in Fed rates in 2025 may soften the dollar, lifting gold, while silver is supported by inflation and industrial demand.

Gold rate and silver prices rose on Thursday as investors shifted to these metals for security. Gold was trading above $3,130 an ounce, up 1.5% from Wednesday, while silver settled at $31.26.

This increase occurred even with a nearly 10 percent advance for the S and P 500 this week, supported by President Trump’s 90 day suspension of US import duties. But fears of a potential US economic slowdown kept gold and silver demand constant. Prospects of four Federal Reserve interest rate cuts in 2025, equal to over 100 basis points, should weaken the US dollar, continued to support gold’s rate.

A falling Chinese yuan, currently at multi year lows, also stimulated interest in these metals as a way to protect against currency risk. Silver also benefited from increased demand owing to its industrial application and inflation concerns.

Ricardo Evangelista, senior analyst at ActivTrades, said that, “This is not just a reaction to tariffs, markets are preparing for a prolonged economic slowdown.”

Gold Rates and Market Insights

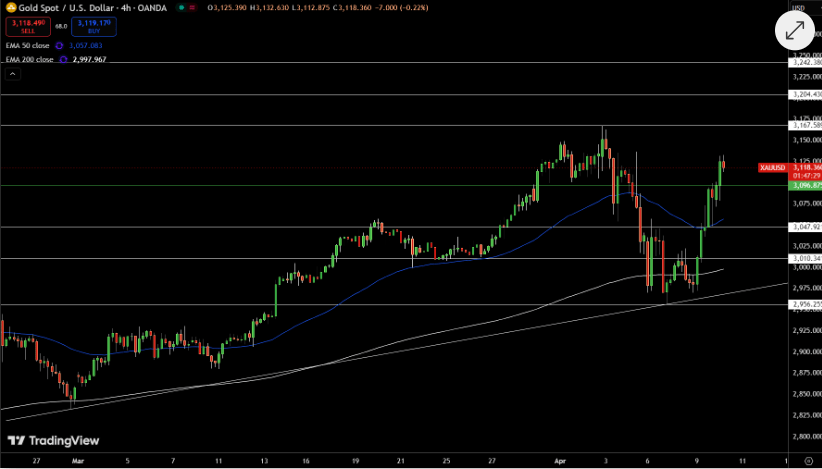

Gold rate remained at over $3,100, challenging resistance at $3,132. Breaking above this level may see it rise to $3,167, with a target of $3,204. Support at $3,096 and $3,047 is maintaining its ground. The 50 day moving average of $3,057 and 200 day moving average of $2,997 offer a firm foundation.

Relative Strength Index stands at 68, representing consistent buying pressure without being excessively overbought. Central banks are still taking in gold, and ETF flows may increase as long as the price holds up above $3,100. Trade tensions and a weakening dollar against China are driving gold to higher prices.

Silver Price Action

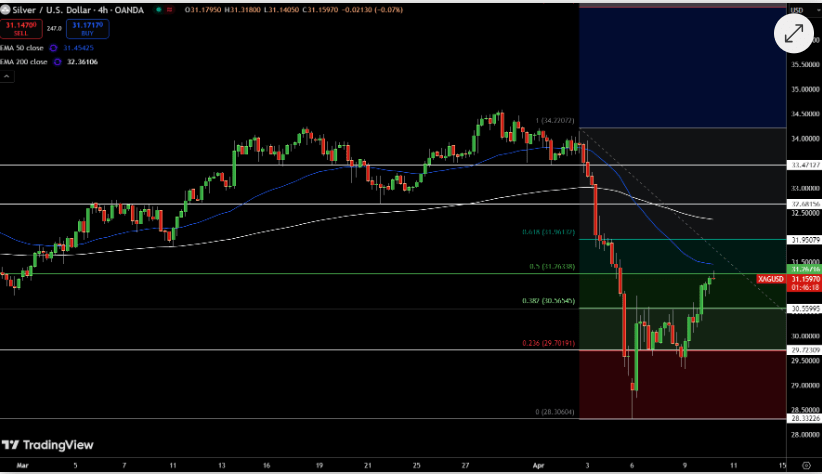

Silver closed above $31.16, just below the $31.26 point after recovering from $29.72 earlier in the week. Breaking $31.26 would drive prices towards $31.96, with the 200 day moving average at $32.36 as the next target. Support is at $30.56 and $29.72.

The near term obstacle is the 50 day moving average at $31.45, and the Relative Strength Index is neutral, suggesting potential for further growth. The appeal of silver lies in its industrial uses and its role as a safeguard against inflation and economic uncertainty.

Jeffrey Roach, Chief Economist at LPL Financial. said that, “Silver’s momentum mirrors that of gold, but with an added speculative edge.”

Gold and silver remain valuable as traditional safe haven assets. With possible interest rate cuts ahead and ongoing trade tensions, both metals, especially gold rates, could see further increases if they stay above their current levels.

Also Read: BlackRock Gets UK FCA Approval for Crypto, What’s the Strategy Behind It?