- Trump placed 34% tariffs on Chinese goods, leading to major market drops globally.

- China responded with its own 34% tariffs and stopped rare earth exports, despite economic pressure.

- Both countries are locked in a serious trade battle, which could grow and affect the whole world.

President Donald Trump recently proposed an additional 34 percent tariff on all Chinese imported goods, and the total amount of duty thus became more than 54 percent when added to current taxes.

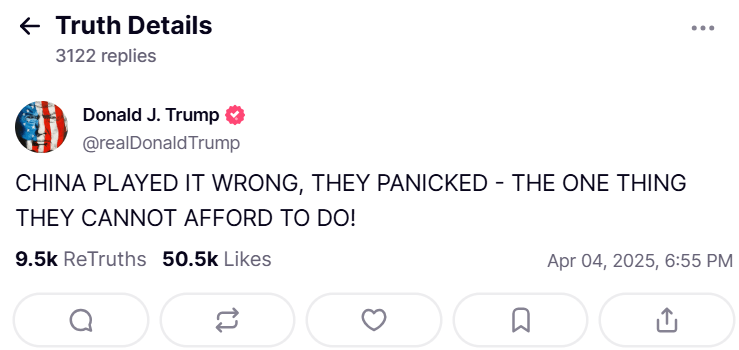

Trump policy, unveiled on April 2, 2025, is intended to combat what Trump refers to as China’s unfair trade practices, including manufacturing benefits and its involvement in the fentanyl crisis. He maintains these steps will make the American economy stronger and richer, writing on Truth Social, “This is a good time to get rich, richer than ever!”

Trump also called for Federal Reserve Chair Jerome Powell to reduce interest rates to aid growth, but Powell warned that these unexpectedly high tariffs could increase costs, slow down the economy, and make companies hesitant to start new projects.

Economic Impact on China

For the world’s second largest economy, China, the tariffs are a serious threat.

Morgan Stanley experts project that the peak U.S. tariffs would shave 1.5 to 2 percent from China’s growth in 2025. China depends a lot on exports, and this is another problem for the country, which is already dealing with a property crisis, local government debt, and weak consumer spending after years of COVID lockdowns.

The tariffs could make prices fall even more and create problems for companies that do business with the U.S. On April 7, the Hang Seng China Enterprises Index, which follows Chinese stocks in Hong Kong, declined more than 13 percent, its worst day since the 2008 financial crisis. China’s 10 year government bond yield fell to 1.634 percent, and the offshore yuan fell to 7.3212 per dollar, indicating investor anxiety.

China also reacted quickly and strongly. On April 10, it put 34% tariffs on all U.S. goods, matching Trump’s move and adding to earlier taxes on U.S. farm and energy products. China also stopped sending rare earth minerals, which are important for tech, and blocked some exports to 12 U.S. defense and aerospace companies.

Also, China designated eleven American companies as “unreliable entities,” restricting their business in China, particularly those related to arms sales to Taiwan, which China views as part of its territory. The Commerce Ministry described U.S. tariffs as “a mistake on top of a mistake” and promised to “fight to the end,” reflecting a harsher stance than its previous, more measured reactions.

Origins of the Trade Conflict

This trade war started when Trump, upon assuming office in January 2025, began imposing tariffs to safeguard American jobs and push back against China’s economic push. The situation escalated when China retaliated and Trump threatened additional 50 percent tariffs in case China does not lift its measures by April 8.

This fluctuation has led to heavy losses in the market., as the S&P 500 lost 9.08 percent, the Nasdaq declined by 10.02 percent, and the Dow fell 7.86 percent during the week ending April 4. J.P. Morgan currently believes there are 60 percent chances of a global recession by the end of 2025, an increase from 40 percent previously.

China Plans to Mitigate Impact

China remains firm and is not ready to give in to what it calls unfair pressure from the U.S. On April 5, the Foreign Ministry said China will take strong steps to protect its interests. It has stopped calling for trade talks and is now focused on handling the situation on its own.

To manage the economic impact, China plans to increase domestic spending, as reported by People’s Daily, and may lower interest rates or ease financial rules. Unlike many countries, China’s government doesn’t have to face elections, which gives it flexibility to handle longer periods of economic strain. However, this firm approach may result in a prolonged standoff, with no negotiations expected in the near future to ease tensions.

Looking ahead, this trade dispute may continue to grow, affecting both nations and global trade. The U.S. tariffs, starting April 12, will likely raise prices for American shoppers on items like electronics and clothing. An iPhone with premium features may retail for almost $2,300 if firms raise the prices.

China’s restrictions, like the ones on rare earth minerals, could hurt U.S. tech companies. Other countries, like Canada and the European Union, are also responding. The EU has planned talks with U.S. officials on April 11, but disagreements within the EU could weaken its plan.

China has assets to counter the U.S., such as a big home market and commercial relationships with Asia and Europe. However, it is exposed to risks from continued economic challenges such as debt and declining prices, and exerting too much pressure may end up isolating it internationally.

The U.S. has its strengths, including its consumer base, but increased prices may disturb Americans, and even allies like Senator Ted Cruz caution that tariffs may be “trillions of dollars in new taxes” on consumers. Both sides are standing firm for now, and the way ahead is unclear with no resolution in sight.

Also Read: Did Trump Tariffs Crash the Crypto Market? Investors Lose $500M?