Recent US economic data for September 2024 is released, as Nonfarm payroll report and unemployment figures exceeded expectations, indicating that the US economy is stable. These numbers not only show strong job growth but also suggest that the economy might not need quick action on lowering interest rates.

Payroll Report of U.S September 2024

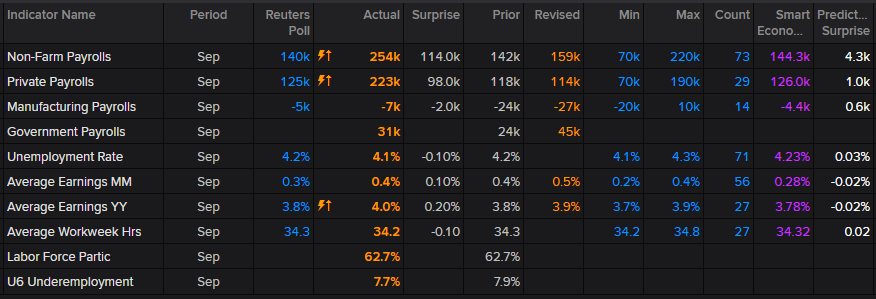

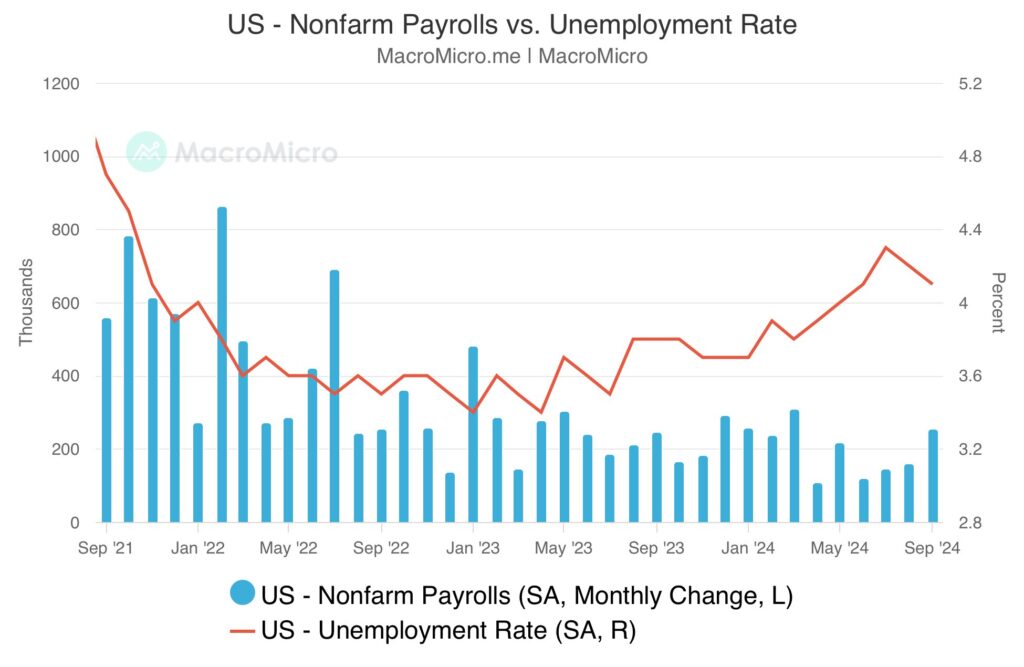

In September 2024, the US economy added 254,000 jobs, a much higher figure than both the forecast of 150,000 and the previous month’s revised figure of 159,000. This represents the largest job gain in the past six months, signalling that the labor market remains strong. For comparison, the average monthly job growth over the past year payroll report has been 203,000, making the September figures higher than the recent trend.

The rise in jobs came mainly from important areas like food services and bars, which added 69,000 jobs. Health care contributed 45,000 new positions, while government roles, both local and state, added 31,000 jobs. Other sectors like social assistance and construction also saw healthy gains, with social assistance increasing by 27,000 jobs and construction by 25,000.

However, there were some declines as well. Manufacturing lost 7,000 jobs, and sectors like mining, wholesale trade, retail, transportation, and financial activities saw little to no change in employment levels.

Upward Revisions in July and August Data

Another important aspect of the September report is the upward revisions for the preceding months. The July payroll report numbers were revised up by 55,000, from 89,000 to 144,000, and August’s figures were revised up by 17,000, from 142,000 to 159,000. This means the total job creation for the summer months of July and August was 72,000 higher than initially reported. These updates show that job growth has been stronger than earlier estimates, emphasizing the strength of the job market.

Unemployment Rate Falls to 4.1%

The unemployment rate also provided a positive surprise in September, falling to 4.1% from 4.2% in August, beating market expectations of 4.2%. This indicates that not only are more jobs being created, but more people are finding employment, contributing to a healthier labor market.

The household survey revealed a significant increase in employment, with 430,000 more people employed in September. This is the biggest increase since March 2024, after a noticeable drop in the previous month. These figures point to strong demand for labor and a continued recovery in the job market.

Wage Growth and Inflation Concerns

While the rise in Nonfarm payroll report and the drop in unemployment are positive indicators, there is a potential concern regarding wage growth and its impact on inflation. Average hourly earnings rose by 0.4% in September, which exceeded market estimates of 0.3%. This follows a similar 0.4% increase in August.

Although wage growth is a sign of a healthy labor market, it can also contribute to inflationary pressures, especially when it consistently exceeds expectations. Higher wages mean more disposable income, which can lead to increased spending, potentially pushing prices up. Inflation watchers are likely to pay close attention to this, as the Federal Reserve looks at future decisions on monetary policy.

A No-Landing Scenario for the US Economy?

The stronger than expected job numbers and falling unemployment rate raise questions about the future direction of the US economy. With such strong labor market data, the idea of a “No landing” scenario where the economy avoids a downturn despite rising interest rates gains traction.

Some market analysts had expected rate cuts by mid-2025, but the strength of the job market suggests that the Federal Reserve may not need to ease monetary policy as aggressively as expected. In fact, some believe the Fed may opt for smaller, incremental rate cuts of 25 basis points over the next four meetings rather than the larger cuts that were previously predicted.

The US economy’s strong footing is partly attributed to high levels of fiscal spending, which continue to support growth and employment. This reduces the need for Major interest rate cuts and gives the economy the ability to handle any possible challenges without much intervention.

Market Reactions: Dollar and Bitcoin

The release of the Nonfarm payroll report data had immediate effects on financial markets. The US Dollar Index (DXY) rose in response to the strong labor market data, reflecting investor confidence in the US economy. Typically, a rising dollar can exert downward pressure on assets like Bitcoin, but in this case, Bitcoin also experienced an increase, going against typical market trends. It is still uncertain how these factors will develop in the coming weeks.

Conclusion

In summary, the US labor market delivered a strong performance in September, with nonfarm payroll report moving to 254,000 and the unemployment rate falling to 4.1%. These figures suggest that the US economy is on a stable condition, with continued job growth and declining unemployment. However, wage growth is still a concern for inflation, and the Federal Reserve may have to be careful when making decisions about future interest rate cuts.

As the economy continues to show resilience, market participants and policy makers alike will be closely watching for signs of how long this strong labor market can be sustained and what it means for the broader economic outlook.