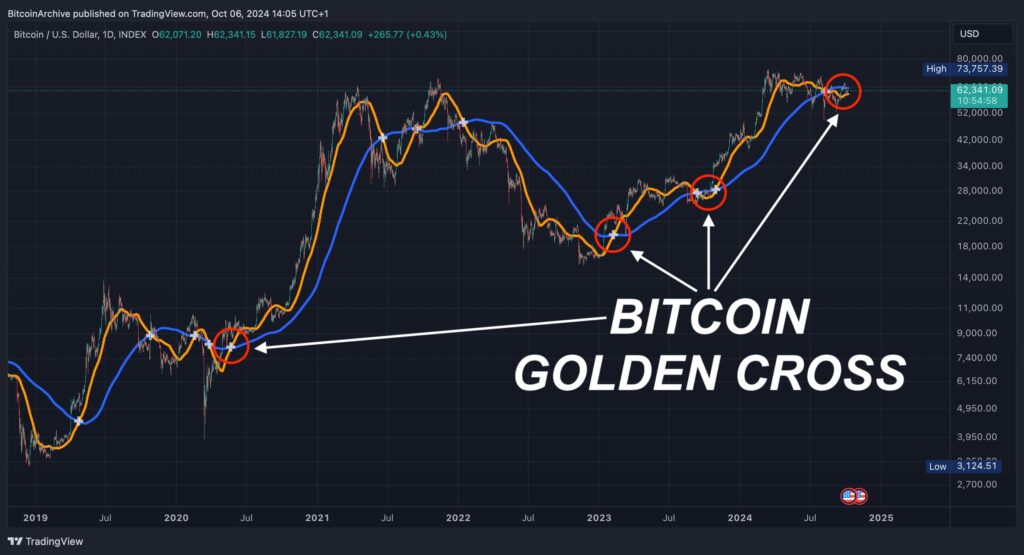

As Crypto Bull Run is the most anticipated event that everyone is waiting for, now Bitcoin is technically approaching the “Golden Cross”, where the 50-week moving average (WMA) is set to cross over the 200-week moving average (WMA). This event is widely regarded as a bullish indicator, signalling the potential for upward momentum that’s where the crypto bull run starts.

On shorter time frames, such as the 4 hour chart, Bitcoin shows a bearish trend, with the 50-day moving average sloping downward. However, the 200-day moving average has been rising steadily since October 2, 2024, indicating a strong underlying trend. Additionally, Bitcoin’s Relative Strength Index (RSI) is currently within the neutral 30-70 range, showing no strong momentum in either direction.

Source : Bitcoin Archive

The Importance of Bitcoin’s Golden Cross For Crypto Bull run

What makes the Golden Cross so important is that it represents the crossover of short term price momentum over longer term trends.

Historically, this pattern has been associated with extended periods of price growth and increased demand, as it reflects growing market confidence in Bitcoin. A rare pattern has also emerged, as the 100-day and 200-day moving averages crossed, forming a golden cross on Bitcoin’s price chart. This event suggests that the shorter term price trend is now outpacing the longer-term trend, which is considered a positive signal for traders and investors.

It’s important to remember, that a similar technical event occurred in the past when Bitcoin’s 100-day and 200-day moving averages formed a “death cross.” Despite the bearish implications of that death cross, Bitcoin defied expectations and surged over 100% to reach a new all-time high of $74,000.

This demonstrates that while technical analysis is valuable, it is not a definitive predictor of future price action. Macroeconomic factors, regulatory developments, and investor sentiment are also crucial to consider when forecasting Bitcoin’s future movements.

Bitcoin and Influential Figures

In recent years, Bitcoin has gained traction not only as a speculative asset but as a recognized store of value, endorsed by key figures in politics, business, and finance.

One of the most surprising endorsements came from former U.S. President Donald Trump. Once a critic of cryptocurrency, Trump’s acceptance of Bitcoin marks a major shift in its perception among global leaders. Trump’s change of stance reflects the growing importance of Bitcoin and digital assets in the global financial ecosystem, especially in terms of hedging against inflation and other economic uncertainties.

Michael Saylor, CEO of MicroStrategy, is another high-profile advocate who has significantly boosted Bitcoin’s reputation. Saylor’s company recently made headlines by purchasing 18,300 BTC, valued at around $1.11 billion, further cementing Bitcoin’s role as a long-term store of value for institutional investors.

Saylor’s continued investments have positioned MicroStrategy as one of the largest institutional holders of Bitcoin, and his bullish outlook is seen as a vote of confidence in Bitcoin’s future. Saylor’s philosophy aligns with the idea that Bitcoin is not just a digital currency but an emerging class of digital gold that can outperform traditional investments over the long run.

Famed investor and author Robert Kiyosaki has also been vocal about his Support for Bitcoin. Kiyosaki, who is best known for his book Rich Dad Poor Dad, views Bitcoin as a critical hedge against government policies and inflation and waiting for the crypto bull run.

The growing institutional interest in Bitcoin is not limited to individual investors and companies. Major firms like MARA (Marathon Digital Holdings) have also played an essential role in Bitcoin’s ecosystem. Fred Thiel, CEO of MARA, has gone as far as to describe “Bitcoin is a National Security”. The significance of Bitcoin in geopolitics is becoming more apparent as governments and corporations increasingly recognize the value of decentralized digital assets.

HBO’s Documentary on Satoshi Nakamoto

Adding to Bitcoin’s growing mystique, HBO is set to release a documentary exploring the elusive Identity of Satoshi Nakamoto, the pseudonymous creator of Bitcoin. The documentary aims to reveal the mystery surrounding Nakamoto’s true identity, a topic that has fascinated the crypto bull run for over a decade.

The intersection of these factors key endorsements from influential figures, growing institutional adoption, and technical indicators like the Golden Cross all suggest that Bitcoin is entering a new phase of crypto bull run.

Uptober and Crypto Bull run

Whale’s such as Justin Sun, founder of TRON, have even hinted at an “Uptober,” speculating that crypto could see positive price movements in the near future. This optimism is supported by a powerful combination of institutional backing, growing mainstream interest, and technical bullish signals for a crypto bull run.

As Bitcoin is reaching key moments, like the upcoming “Golden Cross,” showing its growing importance in the financial world. It’s no longer just a risky investment; now, it’s seen as a way to store value, protect against inflation, and even as a potential national security asset. With support from famous figures and big companies, Bitcoin is set to make another big move. This mix of market trends and institutional backing shows that Bitcoin is becoming a major player in the future of global finance and crypto bull run.