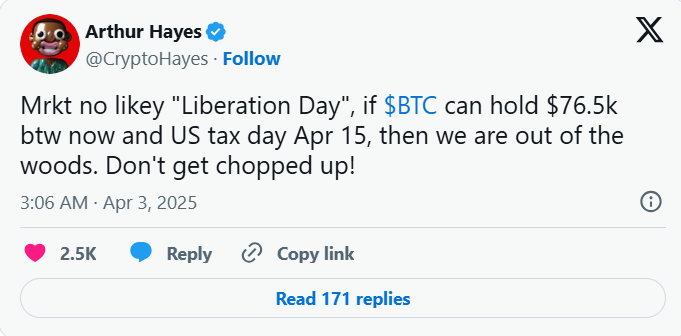

- Arthur Hayes forecasts Bitcoin price will hit $250,000 in 2025 if it holds above $76,500 through April 15.

- He expects Trump’s choice of Treasury Secretary to push the Fed to restart money printing, sending Bitcoin price higher.

- If QE is reinstated, Bitcoin price might reach $110,000 before falling back to $76,500.

Bitcoin price has been fluctuating a lot lately, falling to $83,437 when Trump declared new tariffs. Over the past 24 hours, Bitcoin has traded between $88,466 and $82,182, and traders are becoming more guarded about what’s next.

Arthur Hayes is observing a crucial level and says if Bitcoin remains above $76,500 until April 15, which is tax day in the U.S., then the market will calm down. But he thinks Bitcoin won’t remain low for long and anticipates it will hit $250,000 by the end of 2025. He refers to this time as “Liberation Day,” perhaps in reference to tax-driven sell-offs on Bitcoin’s price.

The Federal Reserve and Bitcoin price in Future

Hayes also thinks that what occurs with the U.S. government’s money policies will have a significant impact on Bitcoin’s future. He believes Trump’s choice of Treasury Secretary, Scott Bessent, will encourage the Federal Reserve to initiate printing more money.

In his blog post, he said that Fed Chair Jerome Powell will not have a choice but to reinstate money printing, or quantitative easing (QE), to address America’s increasing debt. Because fewer foreign nations, particularly China, are purchasing U.S. government bonds, the Fed and domestic banks may have to replace them.

His math is that if the economy grows at 5% while the government keeps borrowing 3% of GDP annually, debt will increase faster than the economy. This can create significant financial issues unless interest rates are brought down or someone comes in to purchase the government’s debt.

Hayes argues Powell has already begun to yield to pressure, noting that the Fed lowered interest rates in September 2024 and recently decelerated the reduction in the Fed’s balance sheet.

Bitcoin’s Path to Six Figures

Bessent has also proposed relaxing banking regulations to enable banks to purchase additional government bonds, which would inject billions of dollars into the system.

The Fed has already slowed the pace of selling its bonds from $25 billion to $5 billion a month, adding an additional $240 billion in liquidity annually. If the Fed goes back to money printing entirely, Hayes feels this will drive Bitcoin’s price much higher.

Putting it into perspective with how gold surged 30% following QE1 from 2008 to 2010, Hayes believes Bitcoin will move even quicker as it is not regulated by any government. Hayes is confident Bitcoin will reach six figures shortly and has $110,000 as the next significant target.

As far as he is concerned, Bitcoin price will not dip back to $76,500 before making new highs. If the Fed begins to print more money, he anticipates Bitcoin price will rise to $250,000 by the end of 2025.

Also Read: AI security in the Wrong Hands: UK to Ban Tools for Creating P***phile Content